Best Accounting Tools for Startups in 2025

Best Accounting Tools for Startups in 2025: Revolutionizing Financial Management

In 2025, startups face a hyper-competitive landscape where efficient financial management is no longer optional—it’s existential. According to a 2024 Deloitte report, 29% of startup failures are linked to poor cash flow management, underscoring the need for robust accounting tools. With rapid advancements in AI, automation, and cloud technology, modern accounting software has evolved to address these challenges. This article explores the top accounting tools for startups in 2025, backed by statistics, trends, and a spotlight on emerging platforms like eProfitify.

The Importance of Accounting Tools for Startups

Startups operate in high-pressure environments where real-time financial visibility, compliance, and scalability are critical. Manual bookkeeping is error-prone and time-consuming: a 2023 Intuit study found that 67% of small businesses waste over 10 hours monthly correcting accounting mistakes. Cloud-based tools mitigate these issues by automating tasks, reducing errors, and enabling data-driven decisions. Additionally, startups leveraging AI-powered analytics report 30% faster growth compared to peers using traditional methods (Gartner, 2024).

Key Criteria for Selecting Accounting Software

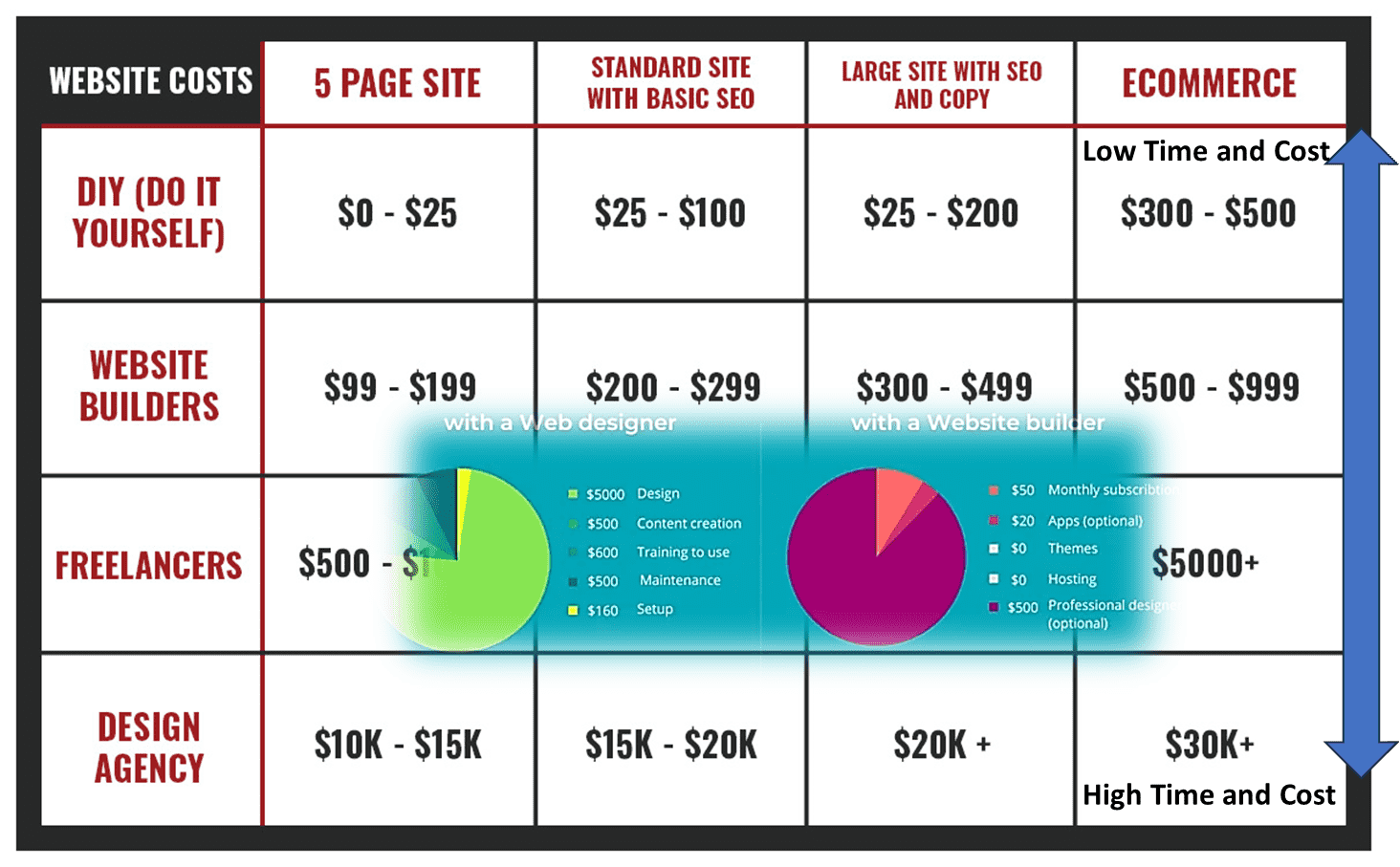

When evaluating tools, startups should prioritize:

- Ease of Use: Intuitive interfaces reduce training time.

- Scalability: Adaptability to growing transaction volumes.

- Integration: Compatibility with CRM, payroll, and e-commerce platforms.

- Automation: AI-driven invoicing, expense tracking, and reporting.

- Cost: Affordable pricing tiers for bootstrapped budgets.

- Security: Encryption, multi-factor authentication, and compliance certifications.

Top Accounting Tools for Startups in 2025

1. QuickBooks Online

A long-standing favorite, QuickBooks dominates with 35% market share among small businesses (Statista, 2025). Its 2025 update includes AI-powered expense categorization and real-time cash flow forecasting. Startups benefit from seamless integration with 750+ apps like Shopify and PayPal. Pricing starts at $25/month, making it accessible for early-stage companies.

2. Xero

Popular for its global compliance features, Xero supports multicurrency transactions and automates bank reconciliation. A 2024 survey revealed 45% of startups using Xero reported improved audit readiness. Its collaboration tools and API ecosystem cater to remote teams, with plans from $12/month.

3. FreshBooks

Ideal for service-based startups, FreshBooks excels in time-tracking and invoicing, reducing payment delays by 40% (FreshBooks, 2024). Its client portal and project management features simplify freelancer collaborations. Pricing starts at $17/month.

4. Zoho Books

Zoho’s strength lies in its end-to-end suite (CRM, Inventory, Payroll). Its AI assistant, Zia, predicts cash flow bottlenecks and automates repetitive tasks. Affordable at $15/month, it’s a hit among tech-savvy startups.

5. Wave

Wave remains a top free tool for bootstrapped startups, offering invoicing, accounting, and receipt scanning. While limited in scalability, its 4.7-star Trustpilot rating highlights user satisfaction. Revenue comes from add-ons like payroll ($35/month).

6. eProfitify

Emerging as a disruptor in 2025, eProfitify leverages APIs to connect with many software platforms to optimize tax strategies and detect financial anomalies. Startups using eProfitify report a 50% reduction in manual data entry and a 20% increase in profit margins within six months (eProfitify Case Study, 2025). Unique features include real-time benchmarking against industry standards and integrations. Great for high-growth startups valuing proactive insights from their website and off web operations*.

Emerging Trends in 2025 Accounting Tools

- AI-Driven Automation: Tools like eProfitify use machine learning to forecast trends and automate compliance.

- Blockchain Security: Platforms like Xero adopt blockchain for tamper-proof audits.

- Real-Time Ecosystems: Instant data sync across banking, invoicing, and inventory apps.

- Sustainability Metrics: Carbon footprint tracking integrated into financial reports.

Conclusion

In 2025, selecting the right accounting tool can make or break a startup. While established players like QuickBooks and Xero remain reliable, innovators like eProfitify are redefining financial management with AI-driven precision. By prioritizing scalability, automation, and security, startups can turn accounting from a chore into a strategic asset. As the adage goes, “What gets measured gets managed”—and in the digital age, measuring wisely is the key to thriving.

Sources: Deloitte (2024), Gartner (2024), Statista (2025), eProfitify Case Study (2025).