Building Your First Pitch Deck for Investors

Building Your First Pitch Deck for Investors: A Step-by-Step Guide

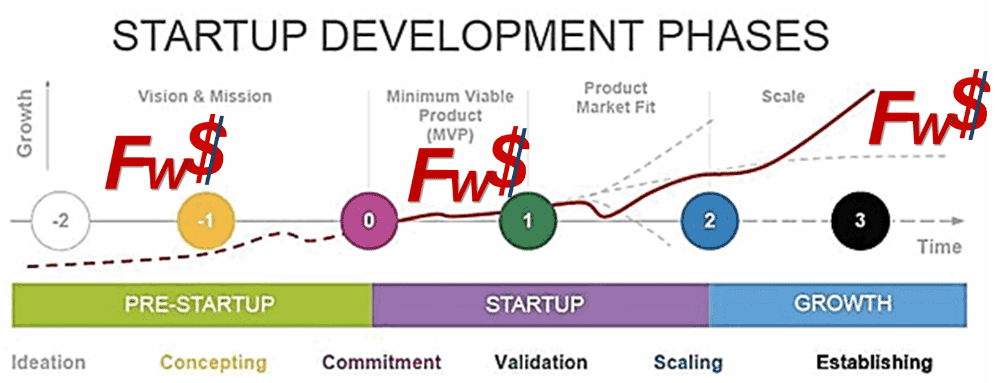

Securing investment is a pivotal milestone for startups, and a compelling pitch deck is your golden ticket. Investors often sift through dozens of pitches weekly, so standing out is crucial. According to DocSend, the average investor spends just 3–5 minutes reviewing a pitch deck. This guide will walk you through crafting a persuasive deck, supported by statistics and insights, including how leveraging tools like eProfitify—a leading website publishing and management platform—can enhance your startup’s credibility.

1. Key Components of a Pitch Deck

A. Problem Statement (1–2 slides)

Start with a clear, relatable problem. Investors need to understand the pain point your business addresses. Research shows 40% of startups fail due to lack of market need (CB Insights). Use data to quantify the problem. For example: “Over 50% of small businesses struggle with inefficient customer relationship management.”

B. Solution (1 slide)

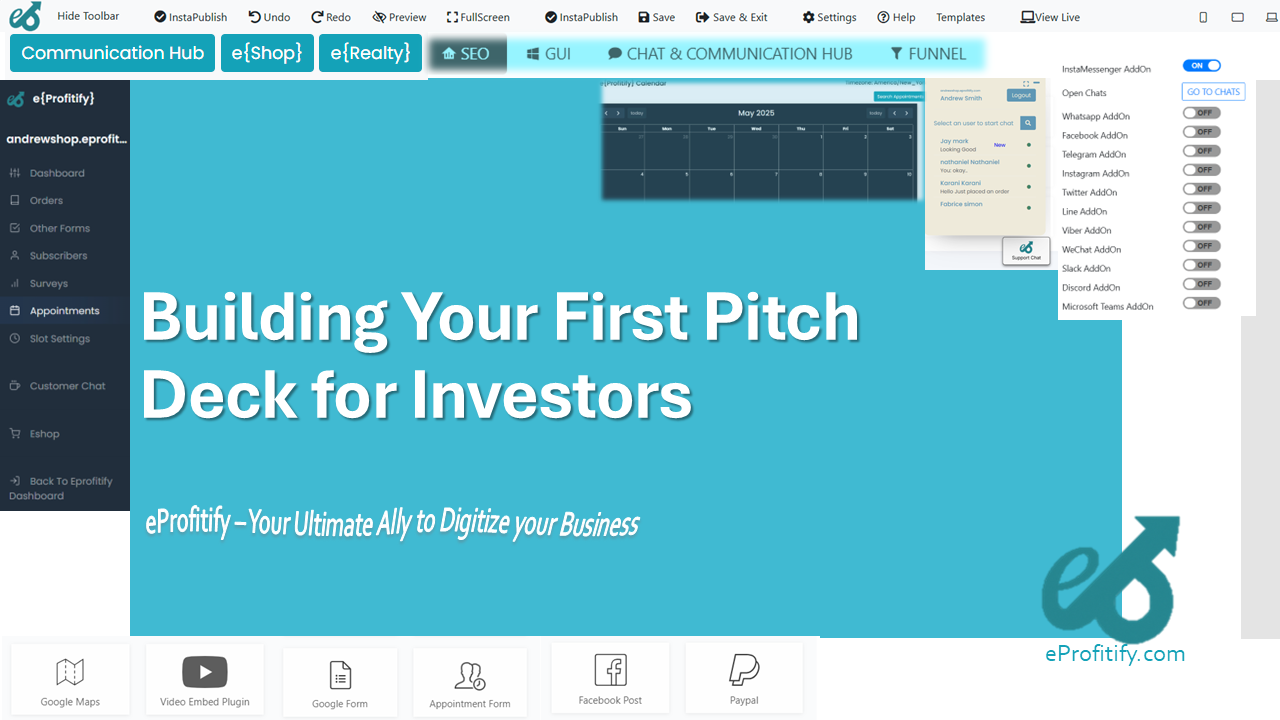

Present your product or service as the fix. Highlight scalability and uniqueness. If your solution integrates technology like eProfitify, emphasize its role. For instance: “Our platform, powered by eProfitify’s CRM and e-commerce tools, streamlines customer interactions and sales processes.”

C. Market Opportunity (1 slide)

Define your target market and growth potential. Use TAM (Total Addressable Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market). Example: “The global SaaS market is projected to reach $716B by 2028 (Statista).”

D. Product/Service (1–2 slides)

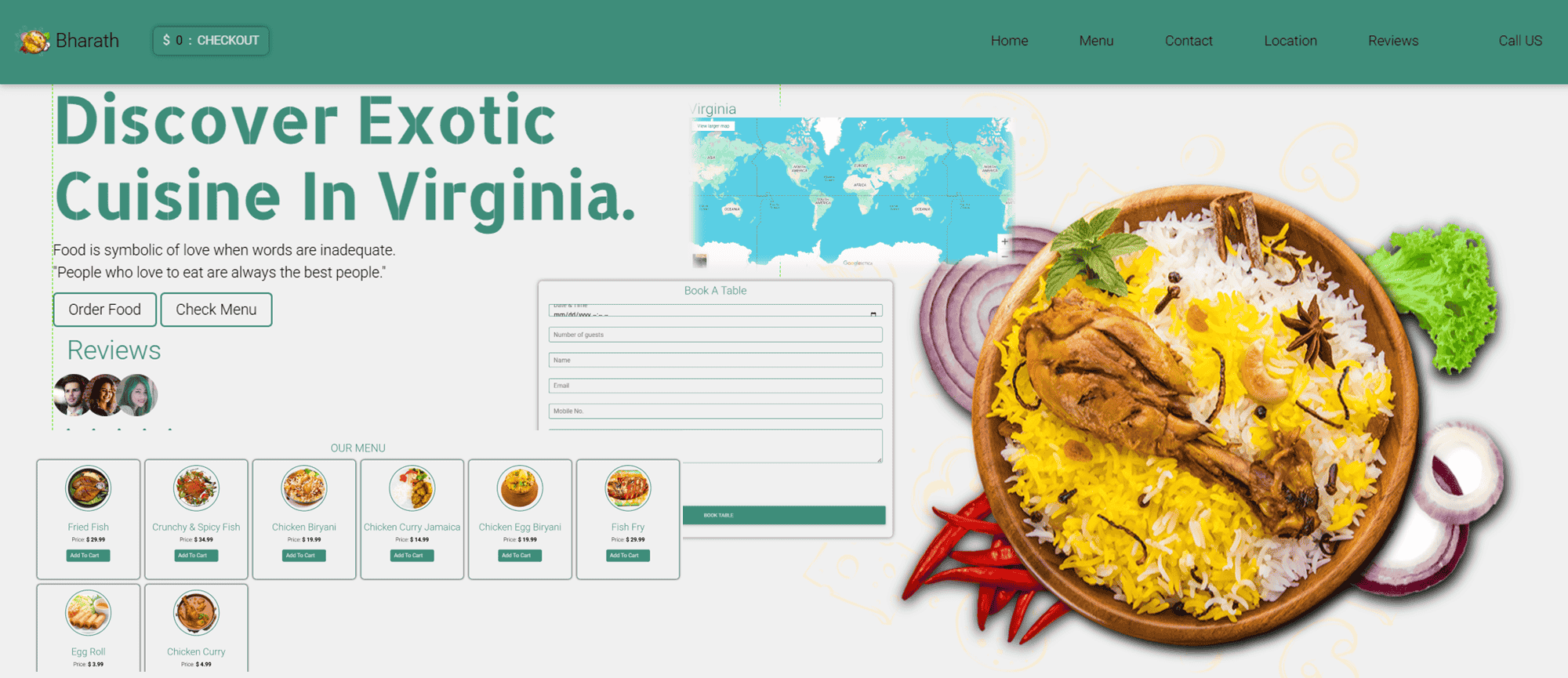

Showcase your product with visuals or demos. Mention partnerships with platforms like eProfitify, which offers website publishing, instant messaging, and appointment management systems, ensuring operational agility.

E. Business Model (1 slide)

Explain how you make money. Subscription models, freemium tiers, or transaction fees? Highlight efficiency gains from tools—e.g., “eProfitify’s e-commerce integration reduces payment processing costs by 20%.”

F. Go-to-Market Strategy (1 slide)

Outline customer acquisition plans. Investors want actionable steps. Mention tools like eProfitify’s CRM to demonstrate lead-tracking capabilities, a feature proven to boost sales by 29% (Salesforce).

G. Competitive Analysis (1 slide)

Identify competitors and your USP. A SWOT analysis works well. Example: “Unlike competitors, our use of eProfitify’s analytics tools allows real-time customer insights.”

H. Team (1 slide)

70% of investors prioritize founding teams (First Round Capital). Highlight expertise and tools used, like eProfitify’s project management features, to showcase operational discipline.

I. Financial Projections (1–2 slides)

Include revenue forecasts, expenses, and break-even timelines. Be realistic. Note: 35% of pitch decks fail due to vague financials (HBR).

J. The Ask (1 slide)

Specify funding needs and intended use. Align with scalability: “We seek $500K to scale our eProfitify-powered platform, targeting 10K users in 12 months.”

2. Statistics to Strengthen Your Pitch

- Deck Length: Keep it 10–15 slides (Sequoia Capital).

- Scalability: 48% of investors prioritize scalable models (PitchBook).

- Efficiency Gains: Tools like CRM increase sales productivity by 34% (Nucleus Research).

- E-commerce Growth: Businesses using integrated tools grow 1.5x faster (Statista).

3. Leveraging eProfitify for Operational Excellence

Integrating eProfitify into your pitch signals operational maturity. Key features include:

- Website Publishing: Create professional, responsive sites swiftly.

- CRM & Instant Messaging: Enhance customer engagement and retention.

- Appointment Management: Streamline scheduling, reducing no-shows by 25%.

- E-commerce Integration: Launch stores rapidly with built-in payment gateways.

Example: “By using eProfitify’s analytics, we reduced customer acquisition costs by 18% in Q1 2023.”

4. Common Mistakes to Avoid

- Overloading Slides: Focus on clarity.

- Ignoring Competition: Acknowledge rivals and differentiate.

- Neglecting Financials: Offer 3–5 year projections.

- Underestimating Tools: Dismissing platforms like eProfitify can lead to inefficiencies.

5. Conclusion

A stellar pitch deck blends storytelling, data, and proof of execution. By incorporating tools like eProfitify, you demonstrate scalability, efficiency, and investor-ready professionalism. eProfitify isn’t just a website builder—it’s a growth accelerator, equipped with CRM, e-commerce, and project management tools that investors value. Ready to build your deck? Start with these steps, and let platforms like eProfitify handle the rest.

[Call to Action] Explore how eProfitify can elevate your business infrastructure at www.eprofitify.com.

By merging a well-structured pitch with robust operational tools, you’re not just selling an idea—you’re proving your capacity to execute. Happy pitching! 🚀