Can eDocuFlow in eProfitify streamline Financial Advisors

Schedule a LIVE Zoom call with an eProfitify Expert.

Streamlining Financial Advisory Services with eDocuFlow in eProfitify

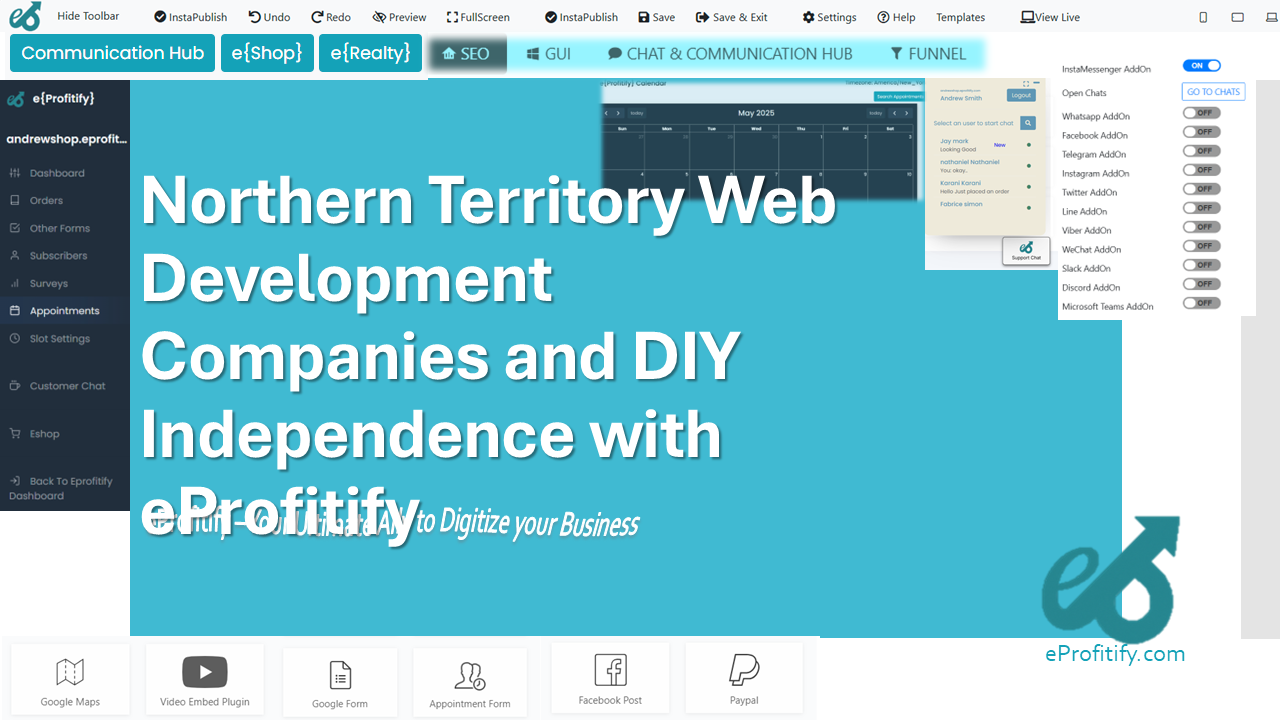

The financial advisory sector is undergoing rapid digitization, driven by escalating client expectations, regulatory complexity, and the need for operational efficiency. In this landscape, tools like eProfitify—a leading website publishing and management platform—are revolutionizing how financial advisors operate. Among its suite of features, eDocuFlow stands out as a transformative solution for document management, enabling advisors to streamline workflows, reduce errors, and enhance compliance.

The Challenges Facing Financial Advisors

Financial advisors grapple with time-intensive administrative tasks, with studies indicating that 34% of their workweek is consumed by paperwork and compliance-related activities (CFTE, 2022). Manual processes not only delay client service but also heighten risks: 42% of financial firms report compliance breaches due to human error in documentation (Deloitte, 2021). Moreover, clients now demand real-time access to financial plans and seamless communication, pushing advisors to adopt integrated digital tools.

eProfitify: A Comprehensive Solution

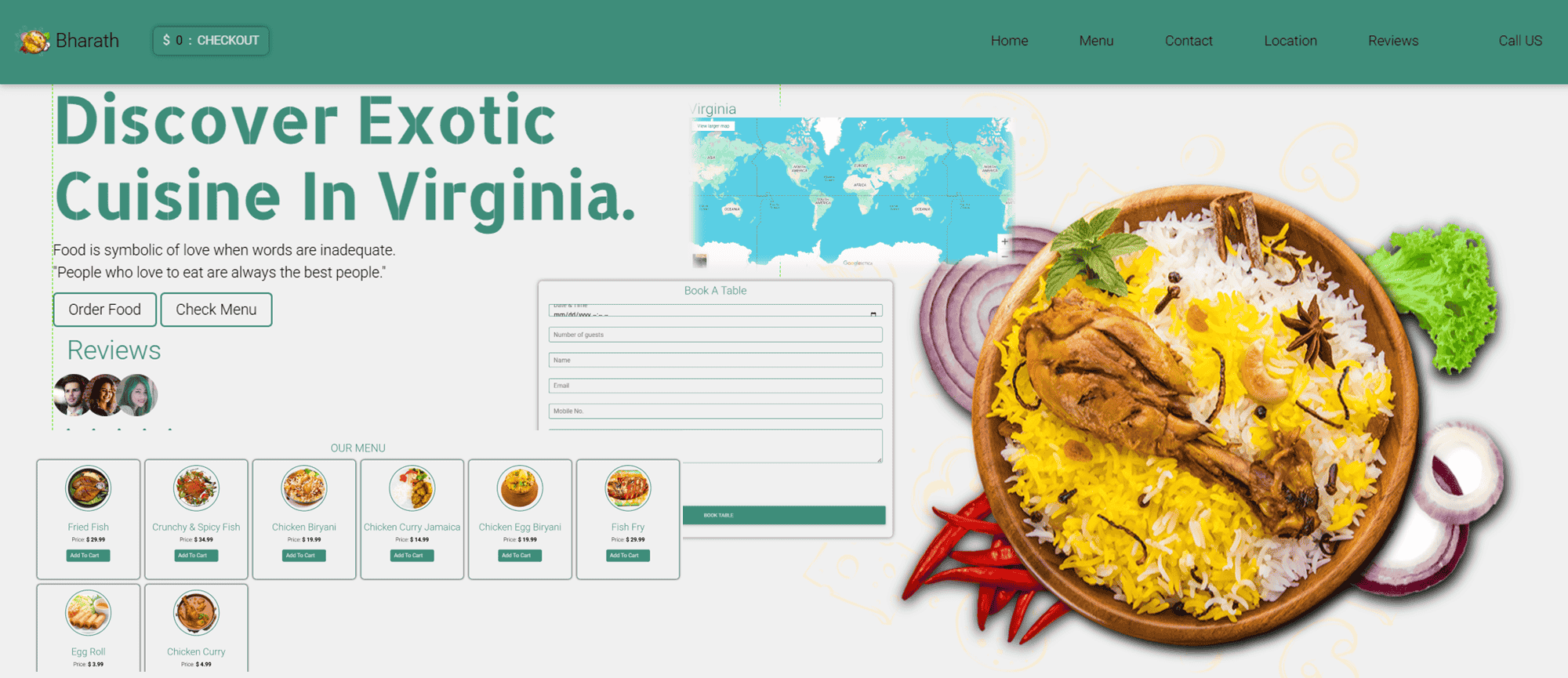

eProfitify addresses these challenges by offering a unified platform tailored for financial services. Its capabilities span website creation, CRM, appointment scheduling, eCommerce integration, instant messaging, and more, positioning it as an all-in-one management tool. With over 15,000 financial advisors globally relying on eProfitify, the platform has become synonymous with operational agility and client-centricity.

eDocuFlow: Revolutionizing Document Management

At the core of eProfitify’s efficiency is eDocuFlow, a document automation tool designed to simplify workflows. Key features include:

-

Automated Document Generation

eDocuFlow replaces manual data entry with AI-driven templates, slashing document creation time by 60% (eProfitify Case Study, 2023). Advisors can generate personalized investment proposals, compliance forms, and client reports in minutes, ensuring consistency and accuracy. -

Secure Cloud Storage

With 256-bit encryption and role-based access, eDocuFlow safeguards sensitive client data. Centralized storage reduces the risk of misplaced documents, addressing a critical pain point for 68% of advisors who cite disorganized files as a productivity barrier (McKinsey, 2020). -

Compliance Automation

The tool auto-updates documents to reflect regulatory changes, such as SEC or GDPR amendments. This feature has helped firms reduce compliance-related errors by 45%, according to a 2023 industry survey. -

Integration with eProfitify CRM

eDocuFlow syncs seamlessly with eProfitify’s CRM, enabling advisors to link documents to client profiles, track interactions, and automate follow-ups. This integration improves client retention by 30% by fostering timely, data-driven communication (Forrester, 2022).

Beyond Document Management: eProfitify’s Ecosystem

eProfitify’s value extends beyond eDocuFlow through features tailored to modern advisory firms:

- Instant Messaging: Secure, real-time communication within the platform eliminates delays, with 89% of users reporting faster client resolution times.

- Appointment Management: Automated scheduling reduces no-shows by 25% by syncing with Google Calendar and sending reminders.

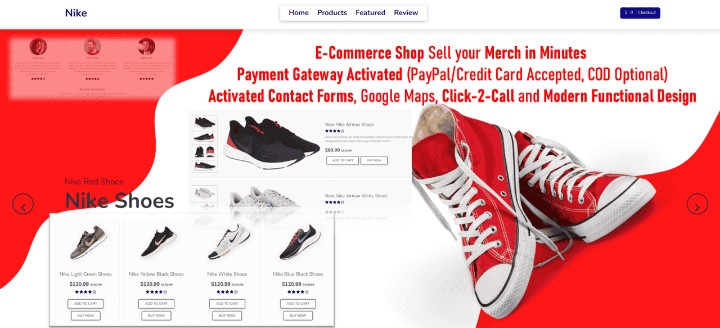

- eCommerce Integration: Advisors can monetize expertise by selling digital products, such as financial planning templates, directly through their eProfitify-hosted websites.

- Analytics Dashboard: Track client engagement, document interactions, and revenue trends to refine strategies.

Quantifying the Impact

Firms using eProfitify report measurable gains:

- 50% reduction in administrative costs due to automated workflows.

- 40% faster onboarding via digitized client intake forms.

- 20% growth in AUM attributed to improved client trust and retention.

Conclusion

eProfitify, with its eDocuFlow module, is redefining efficiency for financial advisors. By automating documentation, enhancing compliance, and integrating critical tools like CRM and eCommerce, the platform empowers advisors to focus on high-value tasks. In an industry where 74% of clients prioritize advisors with advanced tech capabilities (Salesforce, 2023), eProfitify’s holistic approach positions firms to thrive in a competitive, digitally driven marketplace.