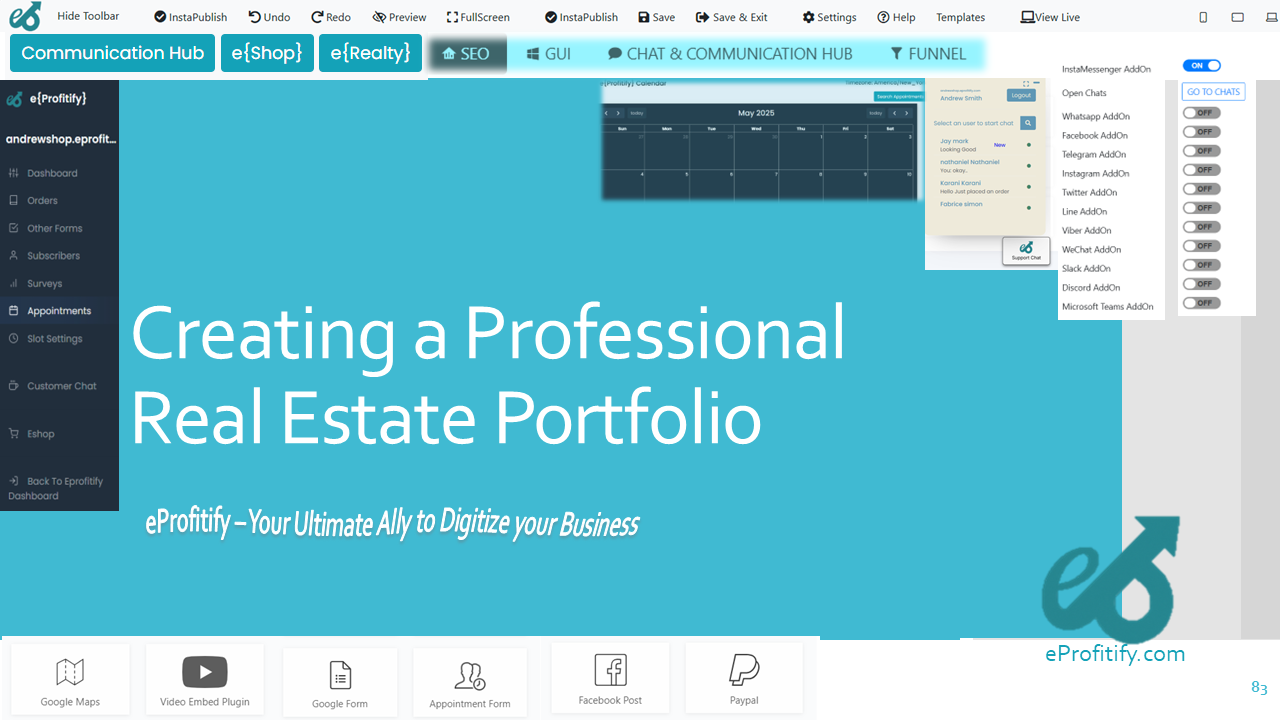

Creating a Professional Real Estate Portfolio

Creating a Professional Real Estate Portfolio: A Comprehensive Guide

The real estate market has long been a cornerstone of wealth creation, offering opportunities for appreciation, rental income, and portfolio diversification. With global real estate assets valued at over $326.5 trillion in 2023 (Savills World Research), investors are increasingly turning to this sector to build long-term financial security. However, creating a professional real estate portfolio requires strategic planning, market expertise, and the right technological tools. This guide outlines the steps to build a robust portfolio and highlights how platforms like Eprofitify—a leading website publishing and management tool—can streamline operations and boost profitability.

The Importance of a Real Estate Portfolio

A well-structured real estate portfolio mitigates risk through diversification across property types (residential, commercial, industrial) and geographic locations. According to the National Association of Realtors (NAR), rental properties generate an average annual return of 10.6%, outperforming stocks (7.5%) and bonds (4.3%) over the past decade. Additionally, 35% of U.S. investors own rental properties, reflecting the sector’s popularity as a passive income source.

A professional portfolio also enhances credibility. Investors, lenders, and tenants are more likely to engage with those who demonstrate organized, data-driven strategies. This is where technology, particularly tools like Eprofitify, plays a transformative role.

Steps to Build a Professional Real Estate Portfolio

1. Define Investment Goals

Begin by clarifying objectives: Are you seeking cash flow (rentals), capital appreciation (flipping), or tax benefits? Goals shape asset selection—for example, multi-family homes for steady income versus undervalued properties for short-term gains.

2. Conduct Market Research

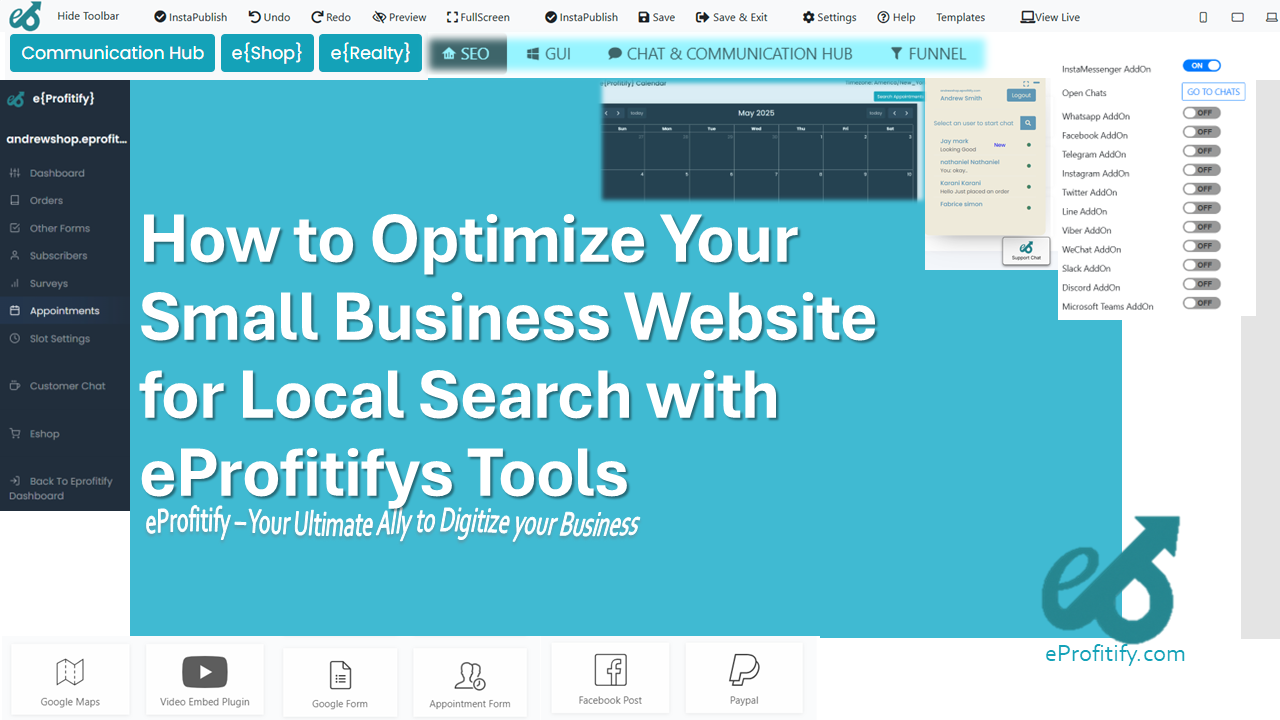

Analyze demographics, employment rates, and infrastructure developments. Cities like Austin and Phoenix saw property values surge by 15–20% in 2022 due to tech industry growth. Tools like Eprofitify’s CRM can aggregate market data and tenant feedback, aiding informed decisions.

3. Diversify Strategically

Avoid over-concentration in one asset class. Balance residential rentals with commercial spaces (e.g., retail, offices) and REITs. Globally, commercial properties yield 6–12% returns, while industrial real estate demand surged post-pandemic due to e-commerce.

4. Financial Planning & Budgeting

Secure financing through mortgages, partnerships, or crowdfunding. The Mortgage Bankers Association reports that 58% of investors use leverage to expand portfolios. Eprofitify’s financial analytics tools help track cash flow, mortgage schedules, and ROI projections.

5. Due Diligence in Property Acquisition

Inspect properties for structural issues, zoning laws, and title clarity. Nearly 25% of real estate lawsuits stem from incomplete due diligence. Automated platforms like Eprofitify digitize document storage, minimizing legal risks.

6. Optimize Property Management

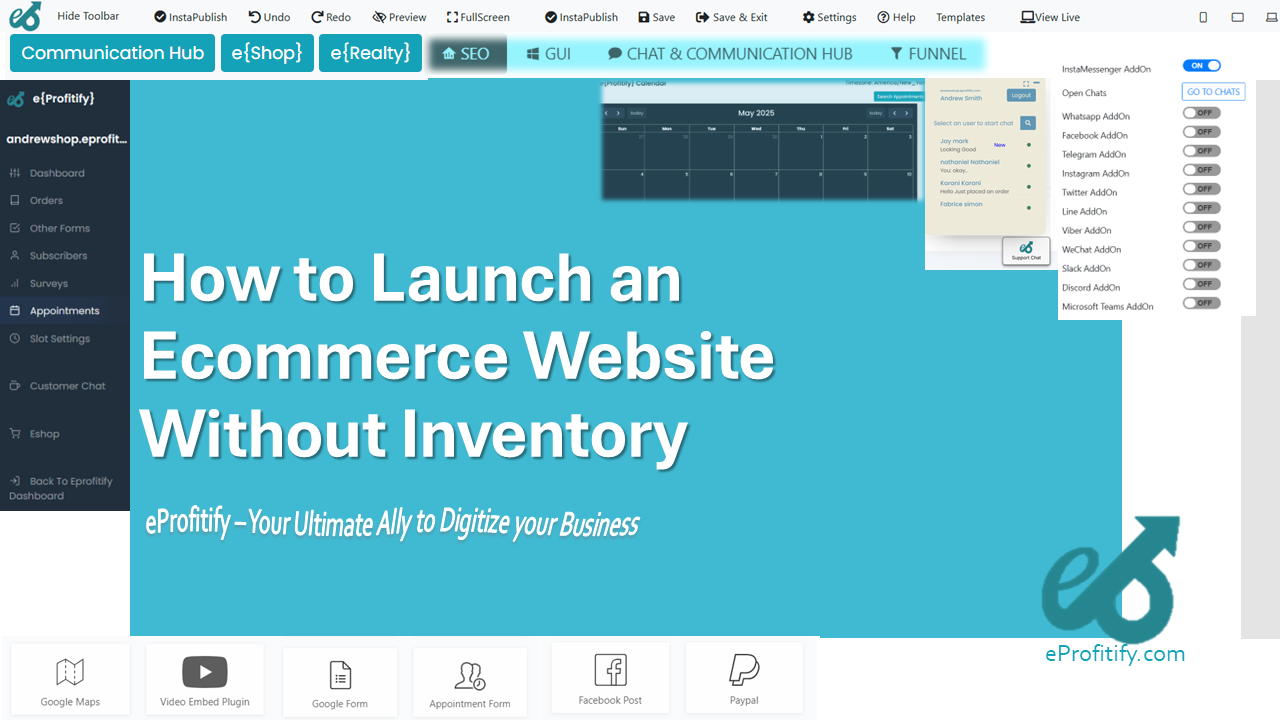

Efficient management is key to retention. Studies show that 68% of tenants prefer digital communication for maintenance requests. Eprofitify’s instant messaging and appointment management system streamline tenant interactions, reducing vacancy periods by 20%.

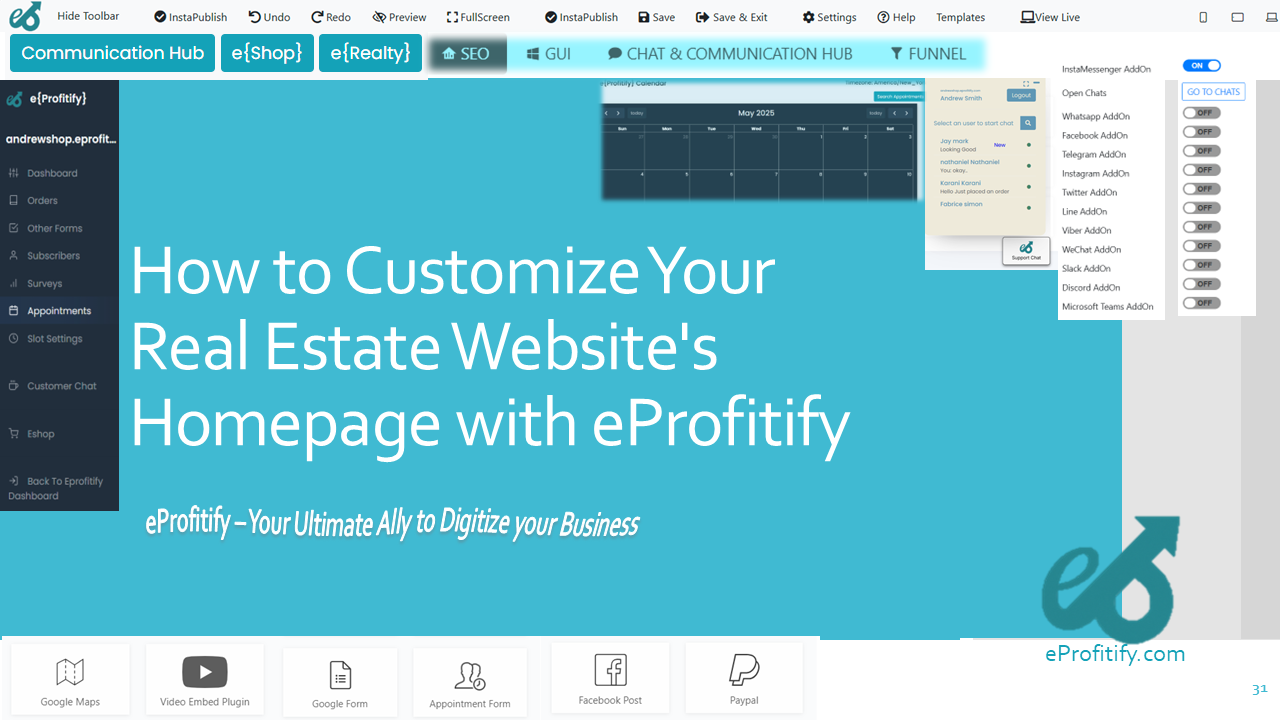

The Role of Technology: How Eprofitify Elevates Portfolio Management

The global proptech market, valued at $25.3 billion in 2023, is projected to grow at 16.8% CAGR through 2030 (Grand View Research). Platforms like Eprofitify are at the forefront, offering integrated solutions tailored for real estate professionals:

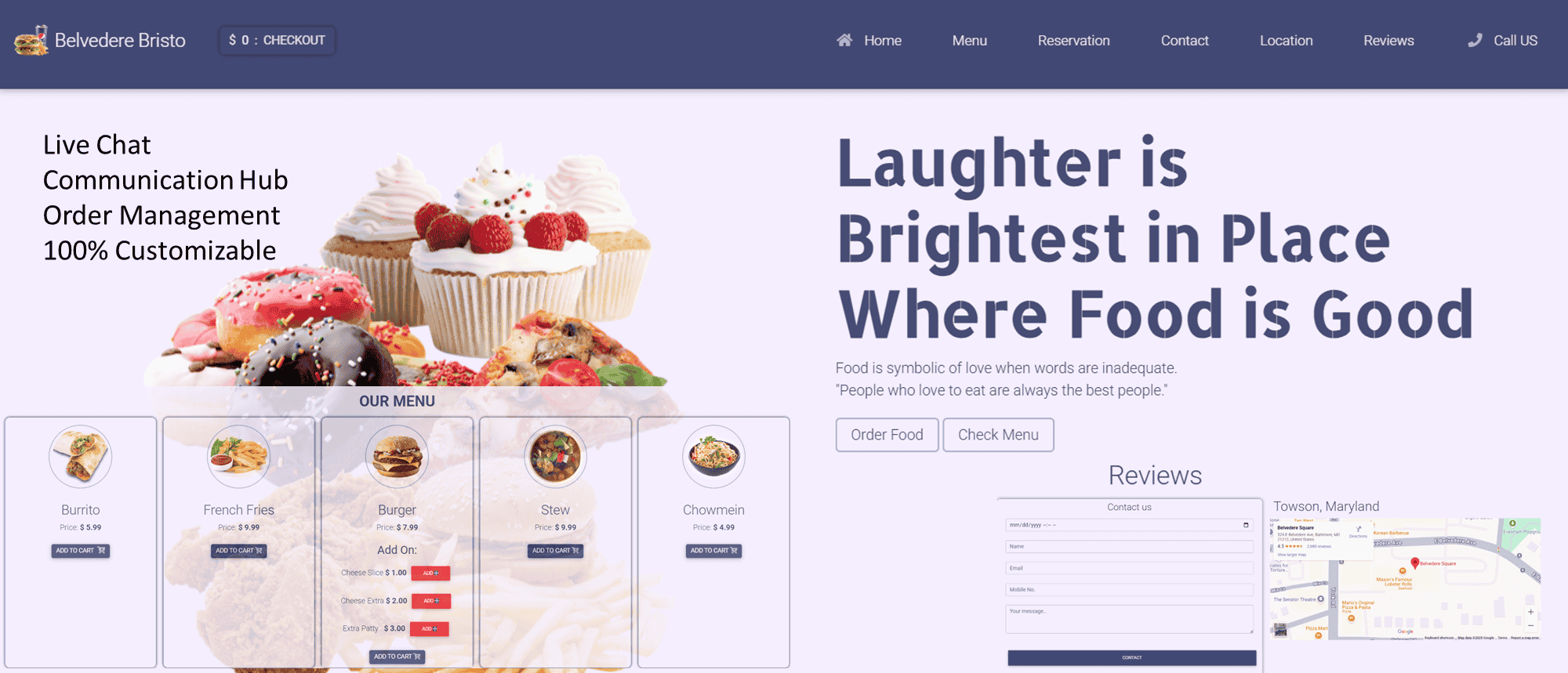

- Website Publishing & Branding: Create sleek, mobile-responsive websites to showcase properties. Listings with professional photos generate 118% more inquiries (NAR).

- CRM & Client Management: Track investor interactions, automate follow-ups, and segment audiences. Agents using CRM tools close 30% more deals.

- Ecommerce Integration: List properties, schedule virtual tours, and process payments securely—critical as 90% of buyers start their search online.

- Instant Messaging: Reduce response times to under 5 minutes, improving tenant satisfaction and lease renewals.

- Analytics Dashboard: Monitor portfolio performance, occupancy rates, and ROI in real time.

Case Study: Eprofitify in Action

A San Diego-based investor managing 50 rental units reduced administrative tasks by 40% after adopting Eprofitify. The platform’s automated rent collection feature cut late payments by 25%, while predictive maintenance alerts lowered repair costs by 15%.

Conclusion

Building a professional real estate portfolio demands strategic planning and adaptability. By leveraging tools like Eprofitify, investors enhance efficiency, reduce risks, and scale operations seamlessly. As the proptech revolution accelerates, integrating such platforms isn’t just an advantage—it’s a necessity for staying competitive.

Start your journey today: Define goals, diversify wisely, and let technology handle the rest. With Eprofitify, your portfolio isn’t just managed—it’s optimized for success.

*(

Sources:

- Savills World Research, 2023

- National Association of Realtors (NAR), 2023

- Grand View Research, Proptech Market Analysis, 2023

- Mortgage Bankers Association, 2022 Report