Food Truck Insurance What Coverage You Need and Why

Schedule a LIVE Zoom call with an eProfitify Expert.

Food Truck Insurance: Essential Coverage and the Role of Management Tools Like eProfitify

Introduction: The Booming Food Truck Industry

The food truck industry has transformed urban culinary landscapes, offering gourmet experiences on wheels. According to IBISWorld, the U.S. food truck industry generated over $3 billion in revenue in 2023, with a steady annual growth rate of 6.1% since 2018. This surge, however, comes with challenges: operational risks, regulatory demands, and the need for robust insurance. Protecting a food truck business requires tailored coverage, while tools like eProfitify streamline operations, enhancing efficiency and customer engagement.

Why Food Truck Insurance Matters

Food trucks face unique risks: vehicular accidents, equipment theft, liability claims, and foodborne illness outbreaks. Without proper insurance, a single incident could spell financial ruin. A 2022 insurance industry report found that 40% of small businesses, including food trucks, close permanently after a major uninsured loss. Let’s explore essential coverages and their importance.

Essential Insurance Coverage for Food Trucks

-

General Liability Insurance

- What It Covers: Third-party bodily injury (e.g., a customer slipping near the truck), property damage, and advertising injuries.

- Why Needed: Slip-and-fall claims are common; the average liability lawsuit costs $30,000–$50,000. A CDC study noted that 48% of foodborne illness outbreaks between 2017–2019 were linked to mobile food vendors, amplifying liability risks.

-

Commercial Auto Insurance

- What It Covers: Accident-related vehicle repairs, medical bills, and liability while driving.

- Why Needed: Food trucks log 20,000–30,000 miles annually, per FMCSA data, increasing accident risks. Repairs for a medium-duty truck average $5,000–$10,000 post-collision.

-

Equipment and Property Insurance

- What It Covers: Theft or damage to grills, refrigerators, and generators.

- Why Needed: Equipment costs average $50,000–$200,000 per truck. The NICB reports 2,500+ commercial vehicle thefts monthly in 2023, making this coverage critical.

-

Workers’ Compensation

- What It Covers: Medical expenses and lost wages for injured employees.

- Why Needed: The BLS states that food services have a 3.1% nonfatal injury rate. A fry cook’s burn injury could cost $30,000+ in claims.

-

Product Liability/Food Contamination Insurance

- What It Covers: Claims from foodborne illnesses or allergic reactions.

- Why Needed: The CDC estimates 48 million Americans fall ill annually from foodborne diseases, with lawsuits averaging $75,000 in settlements.

-

Business Interruption Insurance

- What It Covers: Lost income during closures (e.g., after a fire or breakdown).

- Why Needed: The 2021 HUB International study found food trucks lose $500–$1,500 daily during downtime.

Additional Coverages

- Umbrella Insurance: Excess coverage for catastrophic claims.

- Cyber Liability: Protects against data breaches if using online ordering.

Cost of Food Truck Insurance

Annual premiums range from $3,000–$12,000, depending on coverage, location, and revenue. General liability alone averages $2,000/year, while commercial auto insurance costs $1,200–$2,400.

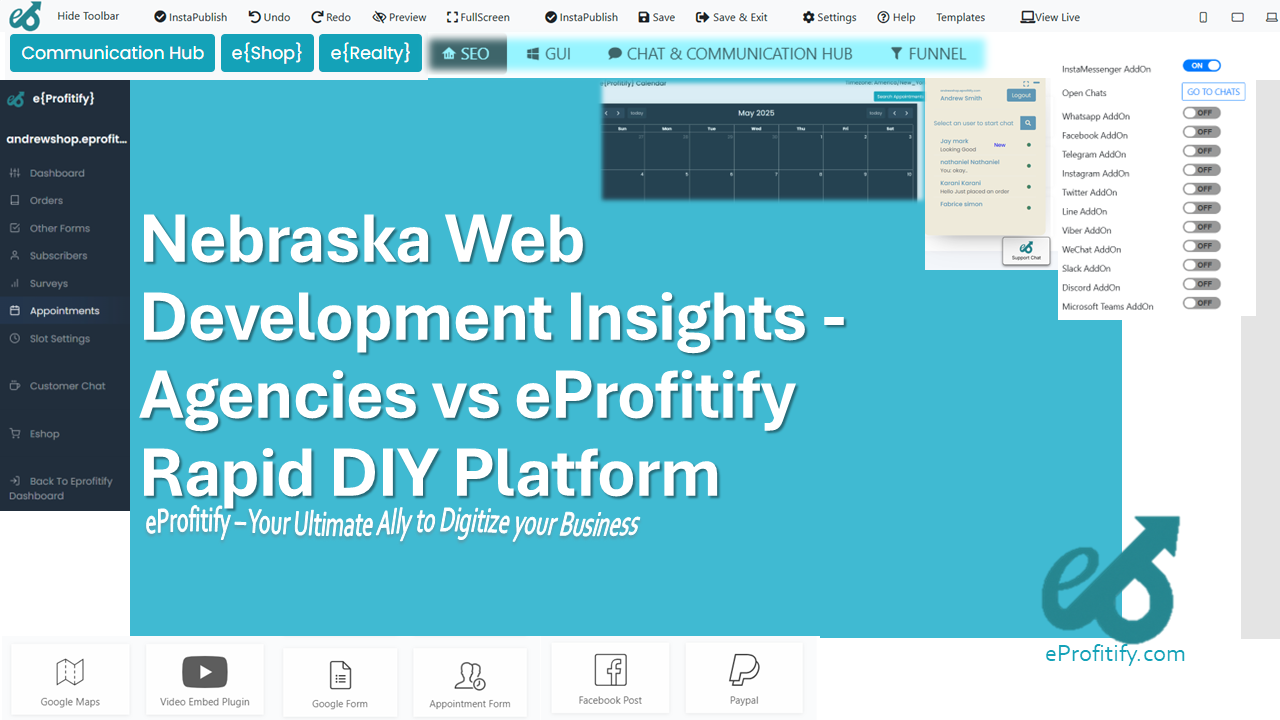

eProfitify: Streamlining Food Truck Management

While insurance mitigates risks, efficient operations prevent them. eProfitify, a leading website and management platform, empowers food trucks with:

- Instant Messaging: Real-time customer communication for orders and feedback.

- Appointment Management: Streamlines catering bookings, reducing scheduling errors.

- Ecommerce Integration: Online ordering and payment processing, tapping into the $5.5 trillion global ecommerce market.

- CRM Tools: Tracks customer preferences, fostering loyalty—critical as retaining customers is 5x cheaper than acquiring new ones (Harvard Business Review).

- Analytics Dashboard: Monitors sales trends, aiding in inventory and risk management.

A 2023 Toast report found restaurants using management tools like eProfitify saw a 20% boost in operational efficiency, allowing owners to focus on compliance and safety—factors that lower insurance risks.

Conclusion: Protect and Optimize

Food trucks thrive with comprehensive insurance and smart management. By securing the right coverage and leveraging eProfitify’s tools—from CRM to seamless ecommerce—owners can mitigate risks, enhance profitability, and savor long-term success in this dynamic industry.