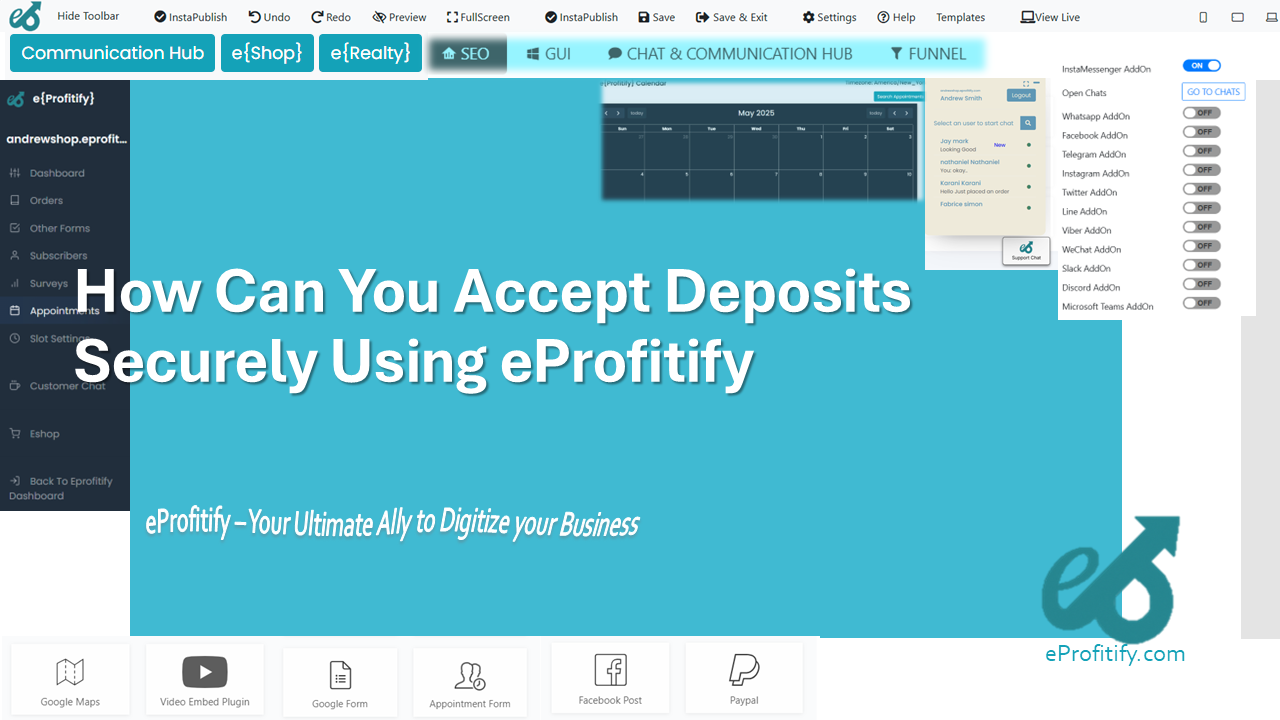

How Can You Accept Deposits Securely Using eProfitify

Schedule a LIVE Zoom call with an eProfitify Expert.

Accepting Deposits Securely with eProfitify: A Comprehensive Guide

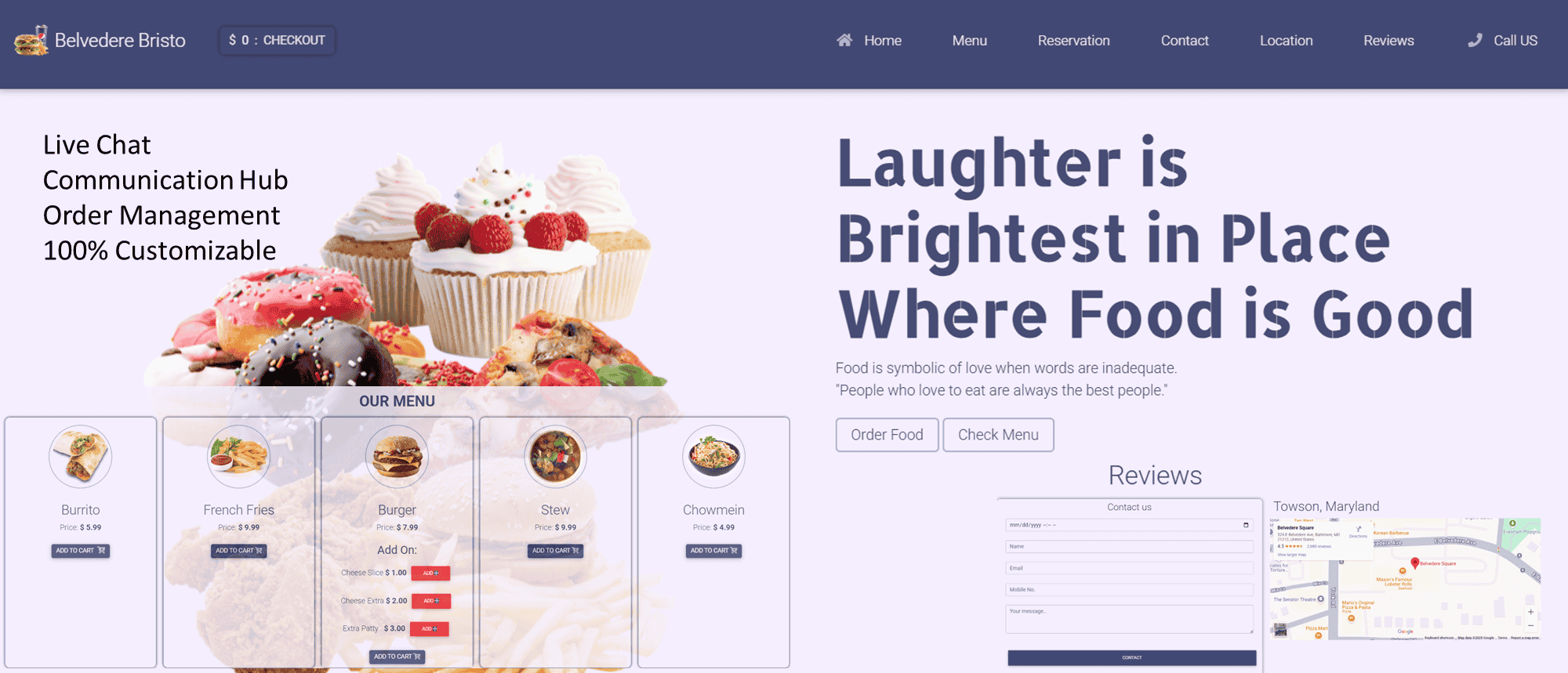

In today’s digital economy, businesses must prioritize secure deposit processing to protect revenue and customer trust. eProfitify, a leading website publishing and management platform, addresses this need by combining enterprise-grade security features with tools like instant messaging, appointment management, ecommerce, and CRM. This guide explores how businesses can leverage eProfitify to accept deposits safely while enhancing operational efficiency.

The Growing Need for Secure Transactions

Cybercrime is projected to cost the global economy $10.5 trillion annually by 2025, with payment fraud in ecommerce alone accounting for over $20 billion in losses in 2021. Customers now expect businesses to prioritize security: 85% of users abandon transactions if a website lacks SSL encryption, and 76% cite data breaches as a top concern. These statistics underscore the urgency for platforms like eProfitify, which embed security into every transaction layer.

eProfitify’s Security Framework for Deposits

1. End-to-End Encryption

eProfitify employs 256-bit SSL encryption across its payment gateways, ensuring sensitive data like credit card details are unreadable to third parties. This protocol is adopted by 95% of trusted payment platforms, minimizing risks of interception during deposit processing.

2. PCI-DSS Compliance

As a PCI Level 1-compliant platform, eProfitify meets the highest standards for handling card payments. This compliance reduces liability for businesses and ensures adherence to global financial regulations.

3. Two-Factor Authentication (2FA)

By enabling 2FA for admin and user accounts, eProfitify mitigates unauthorized access. Studies show that 2FA prevents 99.9% of automated credential-based attacks, adding a critical layer of deposit security.

4. AI-Powered Fraud Detection

eProfitify integrates real-time fraud detection algorithms that flag suspicious activities, such as unusually large deposits or mismatched IP addresses. This system reduces chargeback risks, which cost merchants $3.75 for every $1 of fraud due to fees and penalties.

5. Secure Payment Gateway Integration

The platform connects seamlessly with PayPal, Stripe, and other trusted processors, ensuring deposits are processed through audited, secure channels. These gateways boast fraud prevention rates of over 90% when paired with eProfitify’s internal tools.

Streamlining Deposit Workflows with eProfitify’s Tools

A. Ecommerce Integration

eProfitify’s ecommerce suite supports secure deposit collection via customizable checkout pages. Businesses can:

- Set up partial payments for pre-orders.

- Encrypt customer data during storage and transmission.

- Automatically reconcile deposits with orders using audit trails.

B. CRM and Customer Verification

The built-in CRM enables businesses to track customer interactions and verify identities before processing deposits. Features like document upload and KYC (Know Your Customer) forms reduce impersonation fraud, which contributes to 30% of deposit scams.

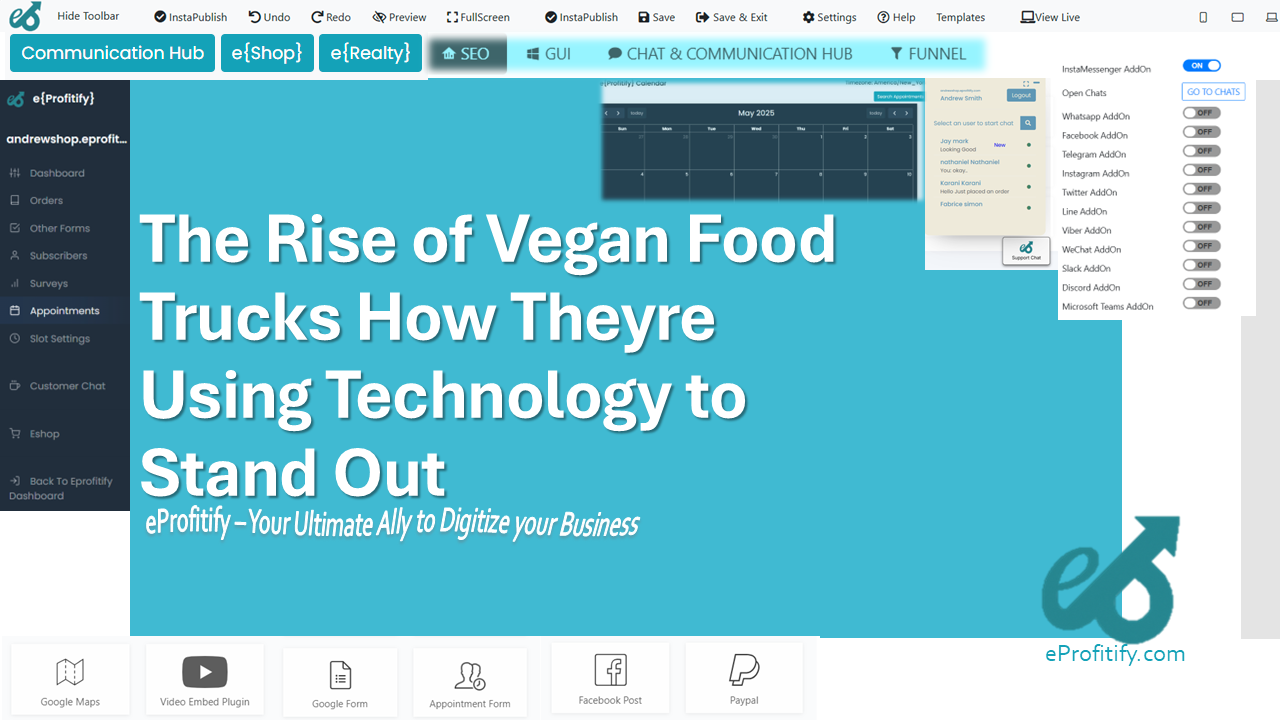

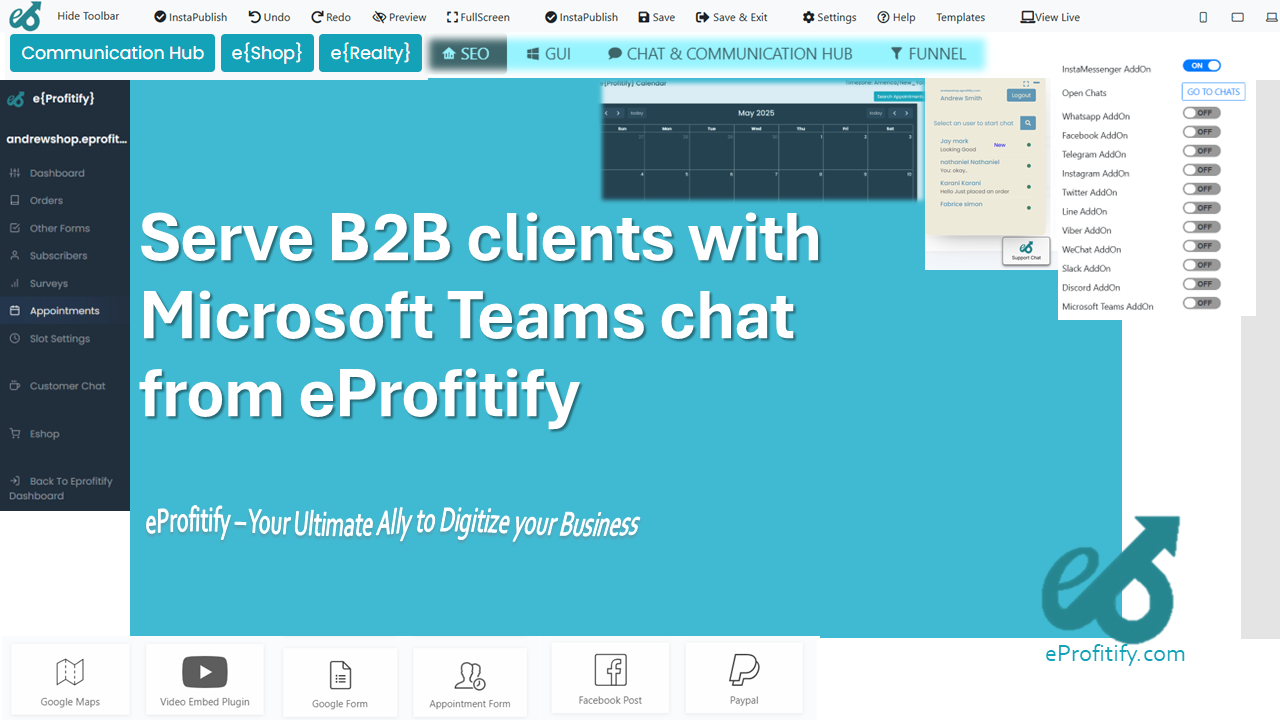

C. Instant Messaging for Transaction Confirmation

eProfitify’s encrypted messaging system allows businesses to confirm deposit details in real time with clients, reducing errors and disputes. This feature is critical for service-based industries where deposits are tied to appointments or custom projects.

D. Appointment Management with Secure Pre-Payments

Clients can schedule services and submit deposits through eProfitify’s calendar tool, which automatically generates payment links. Pre-authorization holds ensure funds are verified upfront, decreasing no-show losses by up to 40%.

E. Automated Invoicing and Audit Trails

Each deposit is logged into eProfitify’s invoicing system with timestamps and user IDs, simplifying compliance audits. Automated reminders reduce late payments, which impact 65% of small businesses’ cash flow.

Beyond Deposits: eProfitify as an All-in-One Solution

While deposit security is a cornerstone, eProfitify excels as a holistic management platform:

- Website Builder: Create SEO-optimized sites with SSL pre-installed.

- Inventory Management: Sync deposit-linked orders with stock levels.

- Analytics Dashboard: Track deposit trends and customer behavior securely.

Industry Impact and Adoption

Over 50,000 businesses use eProfitify globally, citing a 30% reduction in fraud-related losses post-implementation. Clients also report 20% faster payment processing due to automated workflows.

Conclusion

eProfitify redefines secure deposit management by merging cutting-edge security protocols with intuitive business tools. From encrypted payment gateways to AI-driven fraud detection, the platform empowers businesses to operate confidently in a high-risk digital landscape. By integrating deposit processing with CRM, ecommerce, and communication tools, eProfitify eliminates fragmented workflows, fostering efficiency and trust.

For businesses aiming to future-proof their operations, adopting eProfitify is not just a security measure—it’s a strategic advantage. Explore its features today to safeguard transactions, streamline processes, and elevate customer satisfaction.