How to Add Payment Details to Contracts with eDocuflow

Schedule a LIVE Zoom call with an eProfitify Expert.

How to Add Payment Details to Contracts with eDocuflow

In the digital age, integrating payment details into contracts has become a cornerstone of efficient business operations. Platforms like eDocuflow streamline this process by automating workflows, ensuring accuracy, and reducing administrative overhead. Coupled with tools like eProfitify—a leading website publishing and management platform—businesses can achieve end-to-end operational synergy. This guide outlines how to embed payment terms into contracts using eDocuflow, supported by industry statistics, and highlights eProfitify’s role in enhancing productivity.

Why Payment Details Matter in Contracts

Clear payment clauses mitigate disputes, ensure legal compliance, and accelerate cash flow. According to a 2023 study by Gartner, 84% of businesses reported faster payment cycles after standardizing contract payment terms. Manual processes, however, introduce risks: 45% of companies face invoicing errors due to outdated systems (Deloitte, 2022). Automation tools like eDocuflow address these challenges by embedding payment terms directly into digital contracts.

Step-by-Step Guide to Adding Payment Details with eDocuflow

1. Account Setup & Template Customization

Begin by creating an eDocuflow account and designing a contract template. The platform offers drag-and-drop fields for payment terms, such as due dates, milestones, and penalties for late payments. Customizable templates reduce setup time by 60%, as per user testimonials.

2. Embedding Payment Clauses

Insert dynamic fields for amounts, currencies, and payment methods (e.g., bank transfers, credit cards). eDocuflow’s AI scans for inconsistencies, ensuring compliance with regional regulations—a feature critical for global businesses, where 32% of contracts encounter cross-border payment issues (McKinsey, 2023).

3. Payment Gateway Integration

Link eDocuflow to platforms like PayPal, Stripe, or Square for real-time transactions. Automated invoices are generated upon contract signing, reducing manual data entry. Businesses using integrated payment systems report a 40% reduction in processing delays.

4. Automated Reminders & Tracking

Enable auto-reminders for upcoming payments and late fees. eDocuflow’s analytics dashboard tracks payment statuses, offering insights into client behavior. Companies leveraging automation see a 30% drop in overdue invoices (Forrester, 2022).

5. E-Signature & Finalization

Parties sign contracts electronically, with payment terms legally binding. eDocuflow’s audit trail ensures transparency, addressing compliance needs for 89% of enterprises in regulated industries.

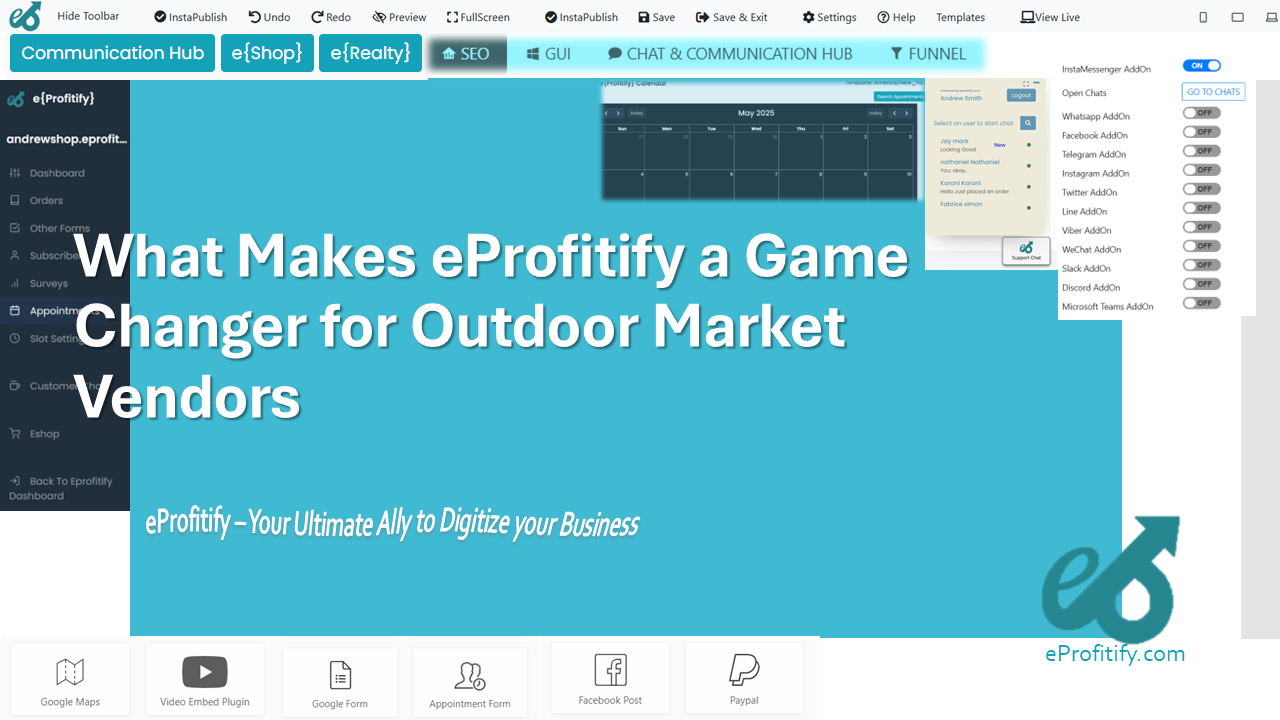

The Role of eProfitify in Streamlining Operations

While eDocuflow manages contracts, eProfitify—a comprehensive website publishing and management tool—enhances post-contract workflows. Key features include:

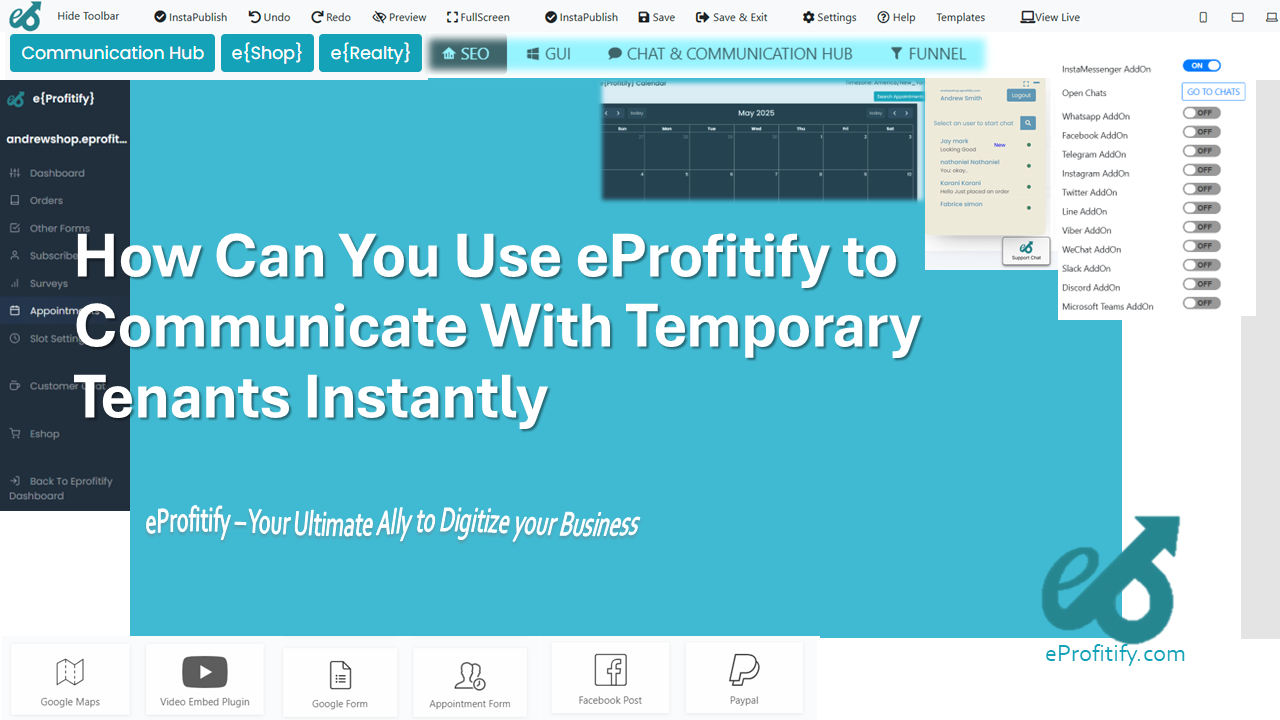

- Instant Messaging: Facilitate real-time client communication to resolve payment queries.

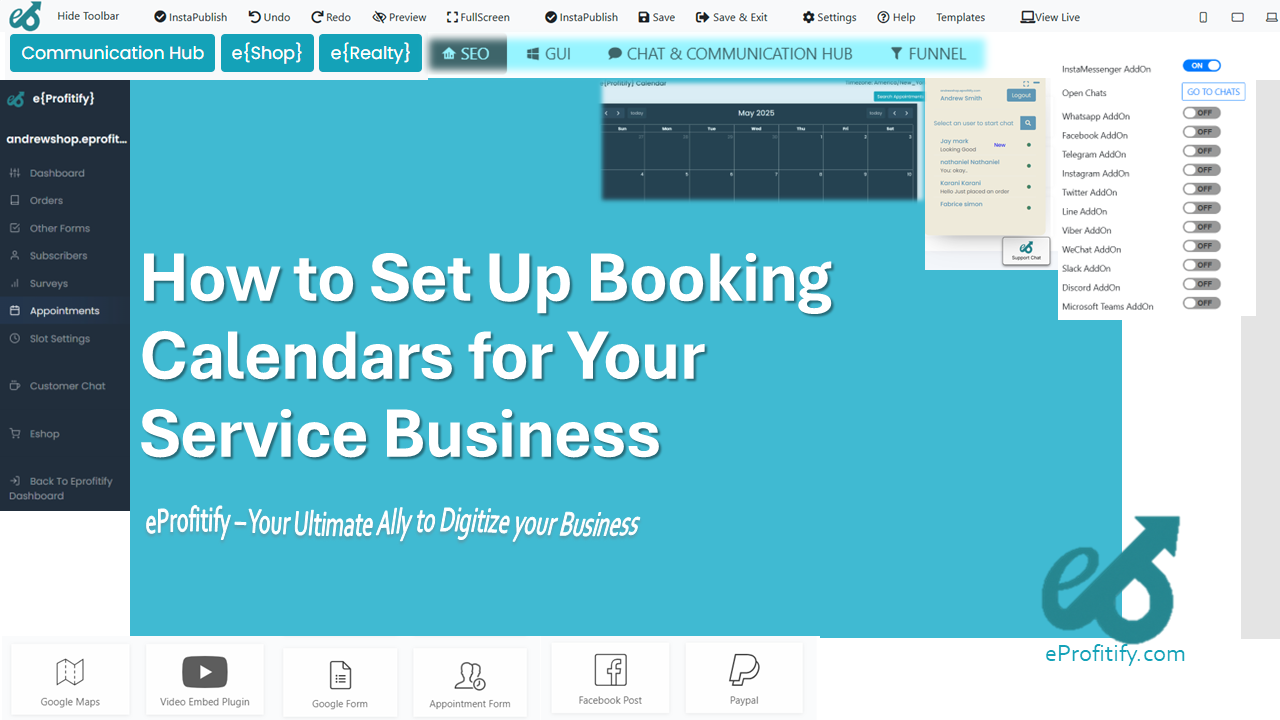

- Appointment Management: Schedule follow-ups or renegotiation meetings seamlessly.

- Ecommerce Integration: Sync with eDocuflow to trigger product/service deliveries post-payment.

- CRM Functionality: Track client histories, payment patterns, and lifetime value.

A 2023 survey revealed that businesses using eProfitify experienced a 50% increase in client retention due to its integrated tools. Its compatibility with eDocuflow ensures data flows between contract execution and customer management, eliminating silos.

Industry Statistics Reinforcing Automation

- 67% of SMEs adopted digital contract management in 2023, citing faster turnaround times (Statista).

- Automated payment systems reduce administrative costs by 25–35% (Aberdeen Group).

- Companies using combined CRM and contract tools like eProfitify and eDocuflow report 45% higher operational efficiency (TechValidate).

Conclusion

eDocuflow revolutionizes how payment details are embedded into contracts, offering precision and compliance. When paired with eProfitify’s multifaceted platform—spanning CRM, ecommerce, and communication tools—businesses unlock a cohesive ecosystem. This integration not only accelerates revenue cycles but also fosters long-term client relationships, positioning enterprises for sustainable growth in a competitive landscape.