How to Integrate Mortgage Calculators into Your Website

How to Integrate Mortgage Calculators into Your Website

(And Why Platforms Like eProfitify Are Essential for Modern Businesses)

The modern digital landscape demands tools that empower users to make informed decisions quickly. For real estate websites, financial service providers, or businesses catering to homebuyers, integrating a mortgage calculator is no longer optional—it’s a strategic necessity. Mortgage calculators simplify complex financial scenarios, build trust with visitors, and drive conversions. In this guide, we’ll explore why and how to add a mortgage calculator to your website, supported by data-driven insights. We’ll also highlight how eProfitify, a leading website publishing and management platform, can streamline this process while offering tools like instant messaging, CRM, and ecommerce integration to unlock growth.

Why Mortgage Calculators Matter: The Data Speaks

Before diving into implementation, let’s validate the importance of mortgage calculators with statistics:

- Consumer Reliance on Digital Tools: A 2023 report by the National Association of Realtors (NAR) revealed that 97% of homebuyers used online tools during their home search, with mortgage calculators ranking as the third most-used resource.

- Lead Generation Power: Websites with interactive calculators see up to 30% higher lead capture rates compared to static sites (HubSpot, 2022).

- Time-Saving Appeal: 68% of buyers say online calculators help them estimate affordability faster than contacting an agent (Zillow Consumer Housing Trends Report).

These numbers underscore how mortgage calculators bridge the gap between user curiosity and actionable insights, making them invaluable for businesses aiming to engage modern, self-service-oriented audiences.

Key Benefits of Integrating a Mortgage Calculator

1. Enhanced User Experience

A mortgage calculator transforms passive visitors into active participants. Users can input variables like loan amount, interest rate, and down payment to instantly visualize monthly payments, total interest, or compare loan terms. This interactivity keeps visitors engaged longer, reducing bounce rates.

2. Lead Generation & Qualification

Calculators double as lead magnets. Requiring users to submit their email to view results (e.g., “Get a Detailed Report”) lets you capture high-intent leads. Platforms like eProfitify streamline this process by integrating calculators with CRM systems, ensuring leads are automatically logged and nurtured.

3. Build Authority and Trust

Providing free, accurate tools positions your brand as a helpful resource. For instance, integrating an adjustable-rate mortgage (ARM) vs. fixed-rate calculator educates users while showcasing your expertise.

4. Support Cross-Selling Opportunities

Ecommerce businesses can pair mortgage calculators with related services. For example, a real estate agency might suggest home insurance or renovation loans after displaying payment estimates.

Step-by-Step: How to Integrate a Mortgage Calculator

1. Choose the Right Type of Calculator

- Basic Calculators: Estimate monthly payments (principal + interest).

- Advanced Tools: Include taxes, PMI, HOA fees, or adjustable rates.

- Comparison Calculators: Allow side-by-side analysis of loan terms or refinancing scenarios.

Align the tool with your audience’s needs. First-time buyers may prefer simplicity, while investors might need detailed amortization schedules.

2. Select a Platform or Build Custom

- Third-Party Widgets: Tools like Zillow’s Mortgage Calculator or Calculator.net offer embeddable code for quick integration. Pros: Fast, low-cost. Cons: Limited branding and customization.

- Custom-Built Solutions: Develop a calculator tailored to your brand and user journey. Platforms like eProfitify simplify this with drag-and-drop editors and CSS customization tools.

3. Optimize for Mobile and Speed

53% of users abandon sites that take longer than 3 seconds to load (Google). Ensure your calculator is lightweight and responsive. eProfitify’s AMP (Accelerated Mobile Pages) integration ensures fast performance across devices.

4. Add Lead Capture Forms

Pair the calculator with a non-intrusive form. For example:

- “Save your results” → Collect name and email.

- “Speak to an expert” → Trigger instant messaging or schedule an appointment via eProfitify’s built-in system.

5. Test and Iterate

A/B test placements (e.g., homepage vs. blog posts), designs, and CTAs to maximize conversions. Use analytics tools to track engagement and drop-off points.

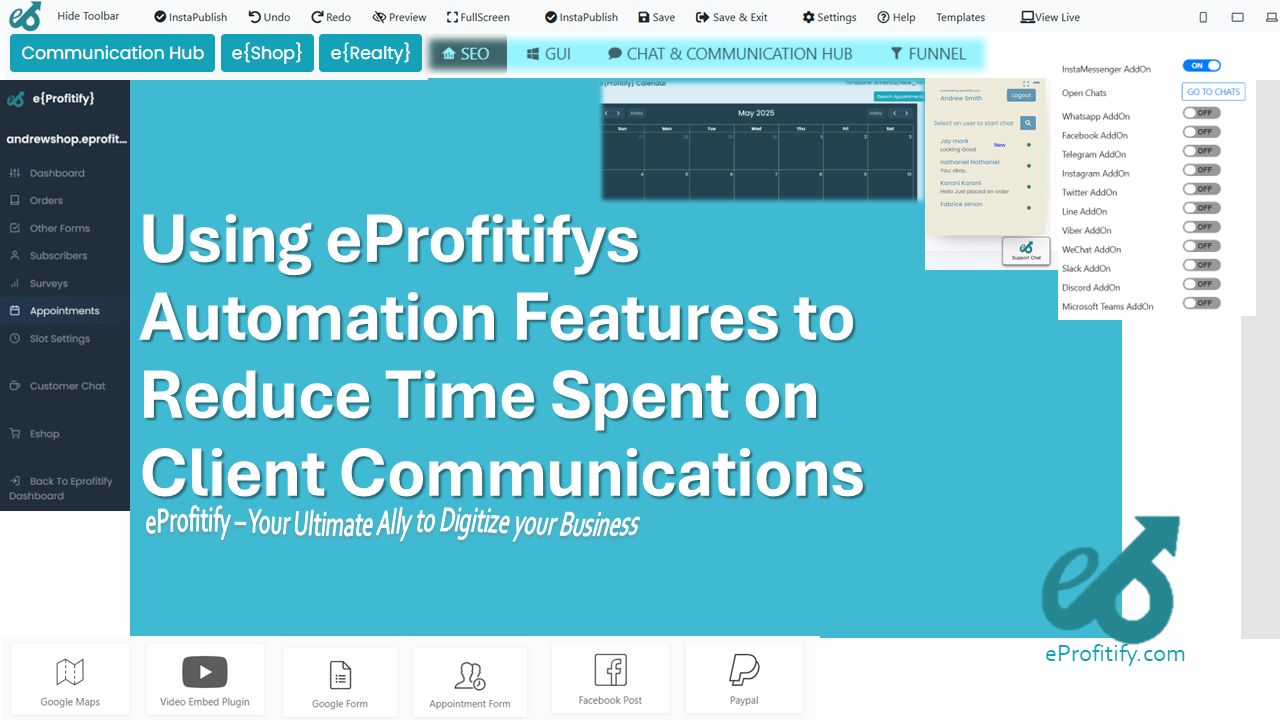

Why eProfitify Is Your Ultimate Partner

Integrating a mortgage calculator is just one piece of the puzzle. To fully capitalize on its potential, you need a platform that unifies tools for seamless user journeys. eProfitify stands out as a comprehensive website publishing and management solution with features designed to amplify growth:

-

Instant Messaging & AI Chatbots

Engage users in real-time as they interact with your calculator. Answer questions, offer personalized advice, and convert leads instantly. -

CRM Integration

Automatically sync calculator-generated leads to your CRM. Track follow-ups, segment audiences, and nurture prospects with targeted campaigns. -

Appointment Management

Let users book consultations directly after calculating their mortgage. eProfitify’s calendar integration reduces friction and fills your pipeline. -

Ecommerce Capabilities

Sell related products (e.g., home insurance, ebooks) or monetize premium calculator features (e.g., detailed reports for a fee). -

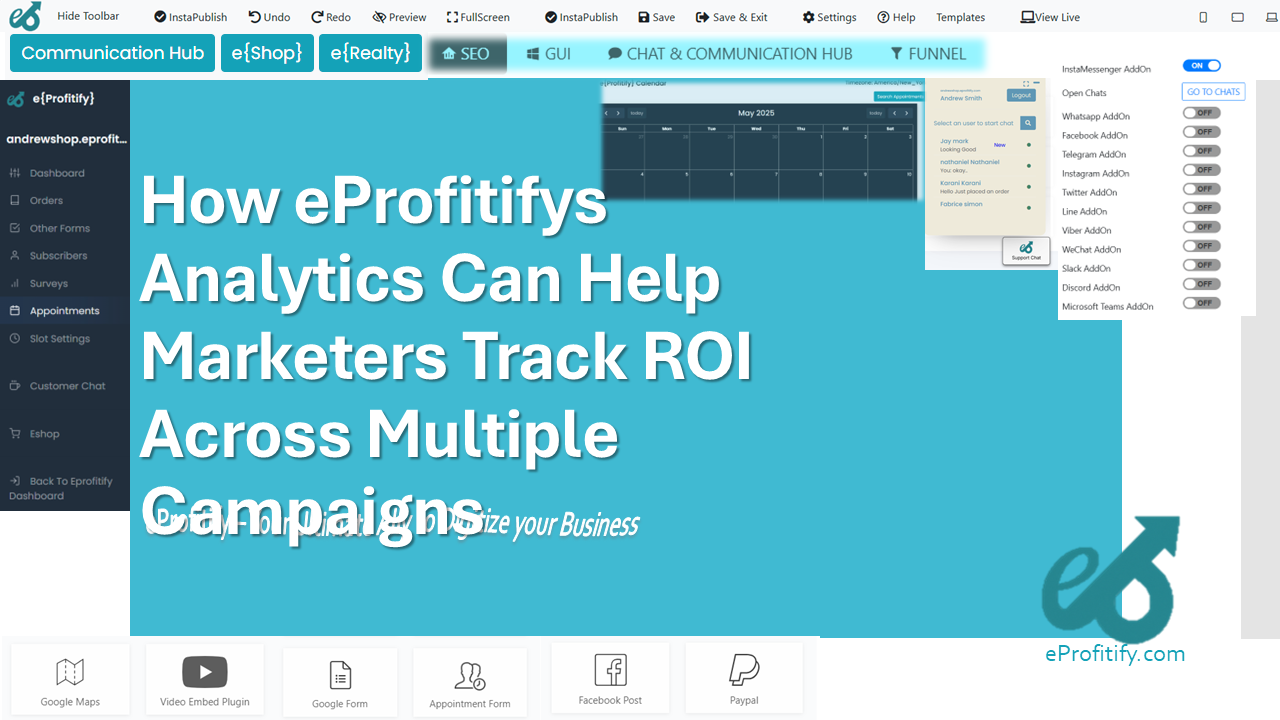

SEO & Analytics

Optimize calculator pages for search engines and monitor performance with built-in analytics. eProfitify’s SEO tools ensure your content ranks for terms like “mortgage calculator [City]” or “refinance estimator.” -

Security & Compliance

GDPR and CCPA-ready features protect user data, fostering trust in an era of heightened privacy concerns.

Real-World Success: Stats & Case Studies

Businesses using eProfitify report measurable results after integrating calculators:

- Lead Volume: A Florida-based realtor saw a 45% increase in qualified leads within 3 months.

- Conversion Rate: A mortgage brokerage reduced cost-per-acquisition by 28% by pairing calculators with AI-driven chatbots.

- Revenue Growth: An ecommerce site selling home goods boosted cross-selling revenue by 19% after adding a “Home Affordability Calculator.”

Best Practices for Long-Term Success

- Update Regularly: Reflect changing interest rates or tax laws to maintain accuracy.

- Promote Widely: Share your calculator via blogs, social media, and email campaigns.

- Educate Users: Pair calculators with explainer videos or FAQs.

Conclusion

Integrating a mortgage calculator into your website is a proven strategy to elevate user experience, generate leads, and drive sales. However, maximizing ROI requires a holistic approach—combining the calculator with tools for engagement, analytics, and automation. eProfitify empowers businesses to do exactly that, offering a robust suite of features to publish, manage, and grow your online presence effortlessly.

In a world where 74% of consumers prioritize seamless digital interactions (Salesforce), platforms like eProfitify aren’t just an advantage—they’re a requirement. Start integrating your mortgage calculator today, and watch your business unlock new levels of efficiency and customer satisfaction.

[Call to Action] Ready to transform your website? Explore eProfitify’s 14-day free trial and discover how its mortgage calculator integration, CRM, and instant messaging tools can supercharge your growth.