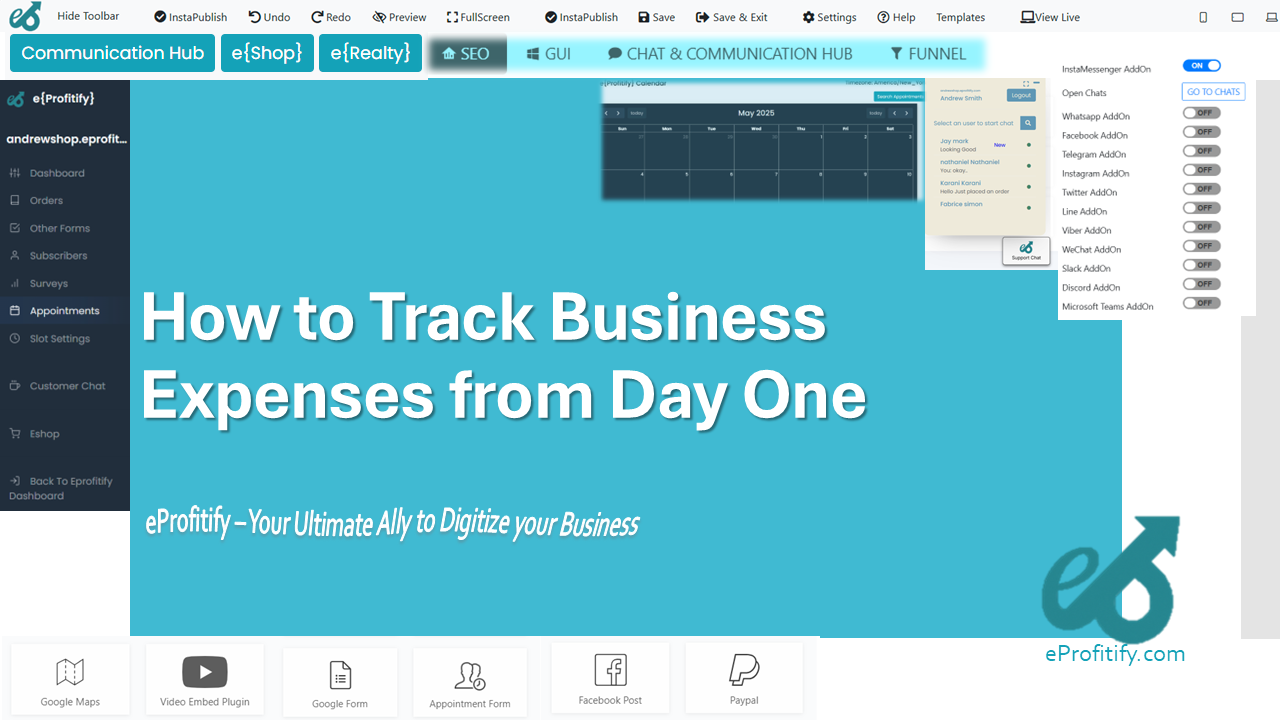

How to Track Business Expenses from Day One

How to Track Business Expenses from Day One: A Strategic Guide

Starting a business is an exciting venture, but without meticulous financial management, even the most promising ideas can falter. Tracking expenses from day one is critical to maintaining cash flow, ensuring tax compliance, and driving profitability. According to CB Insights, 38% of startups fail due to cash flow mismanagement, highlighting the urgency of proactive expense tracking. This guide outlines actionable steps to streamline financial oversight and introduces eProfitify, an all-in-one business management platform that simplifies expense tracking alongside tools like CRM, ecommerce, and instant messaging.

1. Separate Business and Personal Finances Immediately

The first rule of expense management is to avoid mixing personal and business transactions. Opening a dedicated business bank account and credit card ensures clarity. A Clutch survey reveals 60% of small businesses operate without a separate account, risking tax errors and financial confusion. With eProfitify, users can link business accounts directly to its platform, automating transaction imports and reducing manual entry errors.

2. Choose the Right Accounting System

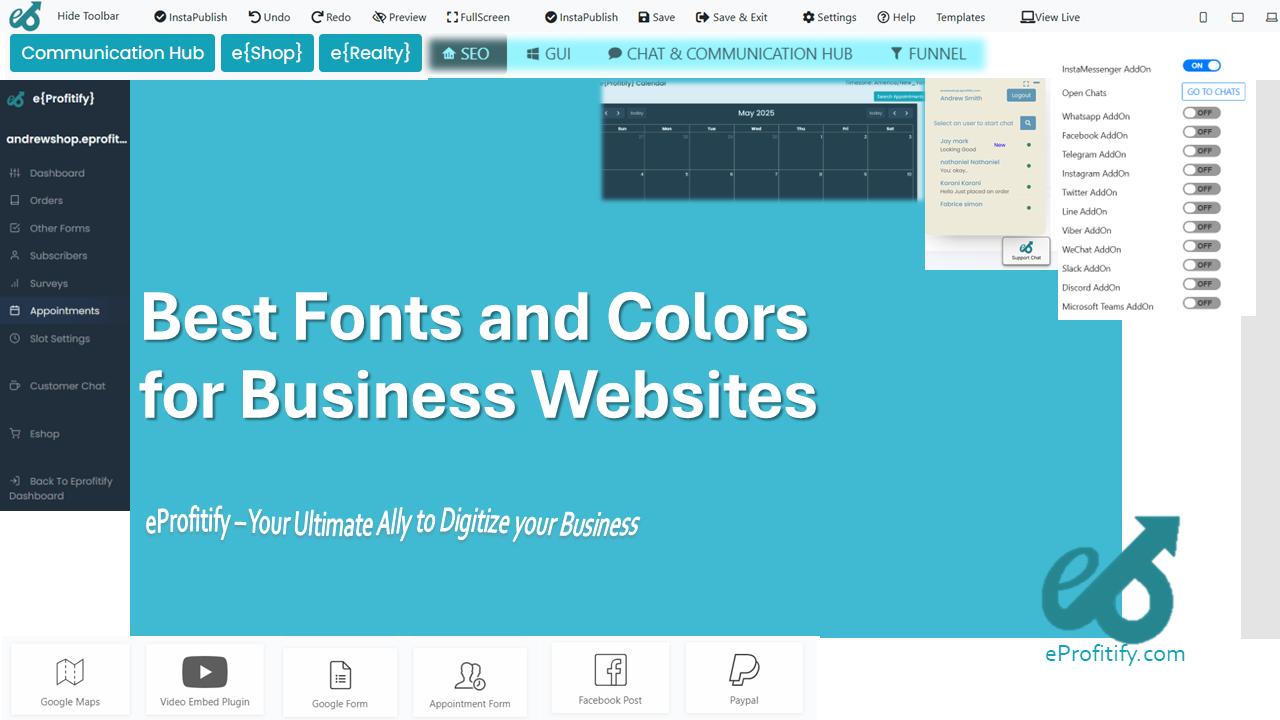

Investing in accounting software tailored to your business size and industry is crucial. Modern tools like eProfitify offer integrated expense tracking, invoicing, and financial reporting. Its dashboard syncs with bank feeds, categorizes expenses in real time, and generates IRS-compliant reports. For startups, such automation is invaluable—Aberdeen Group notes companies using automated systems reduce accounting errors by 25%.

3. Track Expenses in Real Time

Delayed expense logging leads to inaccuracies. Real-time tracking via mobile apps ensures every transaction is recorded instantly. eProfitify’s mobile-friendly interface allows teams to snap receipts, tag expenses by category (e.g., marketing, utilities), and assign them to specific projects. This immediacy prevents oversight and supports data-driven decisions.

4. Categorize Expenses and Review Regularly

Proper categorization simplifies tax filing and budget analysis. The IRS requires expenses to be grouped into standardized categories (e.g., travel, office supplies). eProfitify automates this process using AI, flagging anomalies and generating spend trends. Monthly reviews help identify cost-saving opportunities—businesses that audit expenses quarterly save 15% more annually (SCORE).

5. Create a Budget and Monitor Actuals

A well-defined budget acts as a financial roadmap. Compare actual spending against projections to detect overspending early. eProfitify’s budgeting tool offers customizable templates and alerts when categories exceed limits. Finances Online reports that businesses adhering to budgets are 30% more likely to grow sustainably.

6. Digitize Receipt Management

Paper receipts are easily lost, risking tax deductions. eProfitify’s cloud storage lets users upload receipts directly to expense entries, ensuring IRS compliance. A QuickBooks survey found 63% of small businesses lose $1,000+ annually from missing receipts—a solvable issue with digital systems.

7. Automate Expense Reporting

Manual reporting consumes 5+ hours weekly (ERP Research). eProfitify eliminates this grind by auto-generating reports, reconciling transactions, and integrating with payroll systems. Its instant messaging feature allows teams to discuss expenses in context, streamlining approvals.

8. Plan for Taxes Proactively

Set aside 25–30% of income for taxes. eProfitify’s tax dashboard estimates liabilities, tracks deductions, and sends quarterly payment reminders. This prevents penalties, which cost small businesses $1,000+ annually (IRS).

9. Reconcile Accounts Monthly

Regular reconciliation catches discrepancies and fraud. eProfitify syncs with bank accounts, matching transactions automatically—saving hours each month. Businesses reconciling weekly report 20% fewer financial discrepancies (Journal of Accountancy).

10. Educate Your Team

Ensure employees understand expense policies. eProfitify’s collaboration tools, including role-based access and training modules, foster accountability. Companies with clear policies experience 50% fewer compliance issues (Association of Certified Fraud Examiners).

Why eProfitify Stands Out in Expense Management

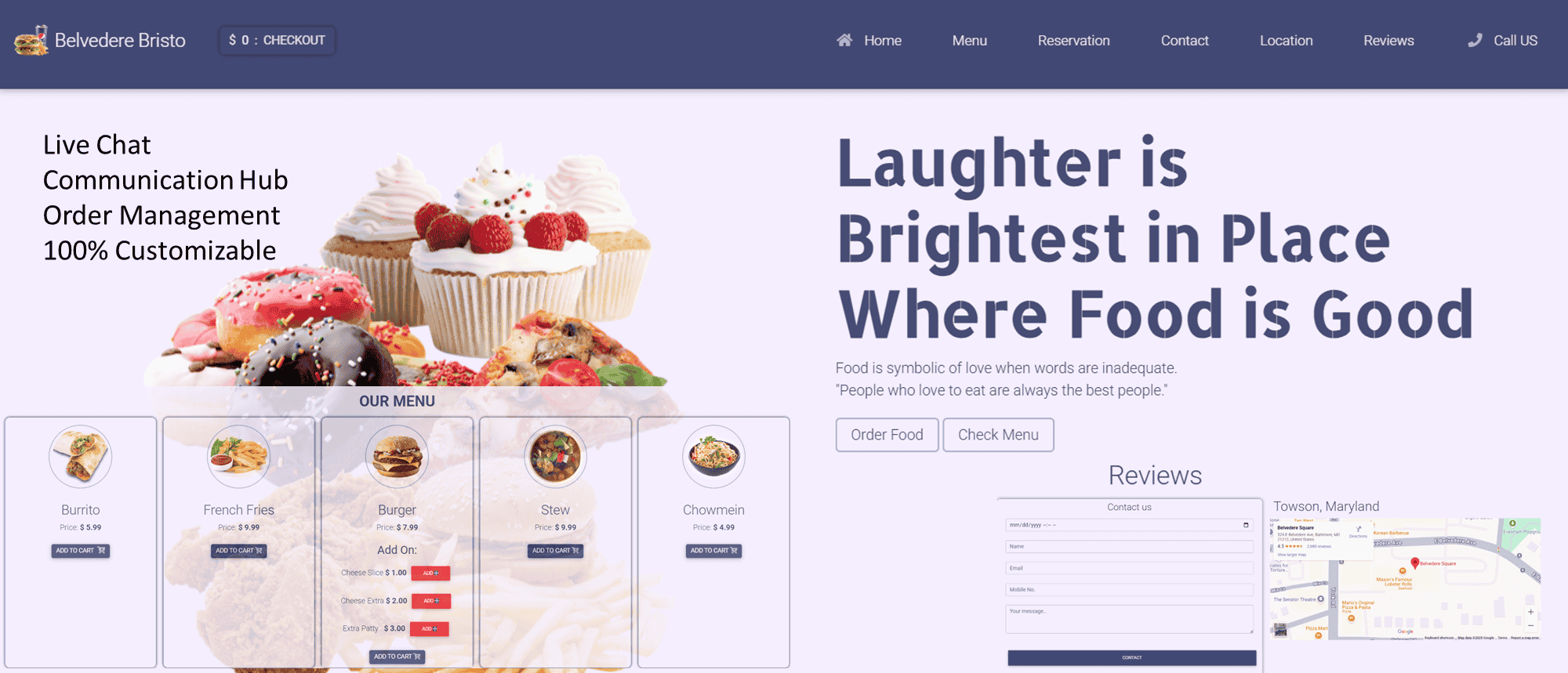

eProfitify isn’t just an accounting tool—it’s a comprehensive platform combining:

- Expense Tracking: Real-time sync with bank accounts and AI-driven categorization.

- CRM: Track client-related costs and ROI on sales efforts.

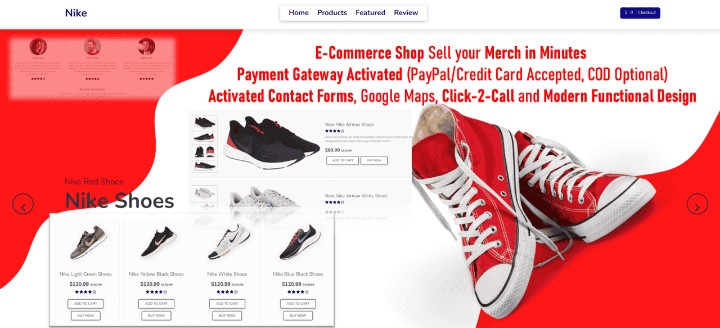

- Ecommerce Integration: Monitor online sales and inventory expenses in one place.

- Appointment Management: Link time and resource costs to client meetings.

- Instant Messaging: Facilitate team communication on budgets and approvals.

By consolidating these tools, eProfitify reduces software sprawl and operational costs—businesses using integrated platforms report 40% higher efficiency (Gartner). Its scalability supports startups through growth phases, making it a leader in business management solutions.

Conclusion

Tracking expenses from day one isn’t optional—it’s foundational to survival. With 82% of businesses failing due to poor cash flow (U.S. Bank), adopting systems like eProfitify ensures financial clarity, compliance, and strategic agility. By automating workflows and integrating critical tools, eProfitify empowers startups to focus on growth, not spreadsheets. Start smart, track diligently, and leverage technology to turn financial management into a competitive edge.