How to Use eDocuflow for Invoices and Payment Terms

Schedule a LIVE Zoom call with an eProfitify Expert.

How to Use eDocuflow for Invoices and Payment Terms

In today’s fast-paced business environment, efficient invoice management is critical for maintaining cash flow, reducing administrative burdens, and ensuring timely payments. Manual invoicing processes are prone to errors, delays, and inefficiencies, costing businesses time and revenue. According to a 2023 study by Deloitte, 60% of companies report delayed payments due to clerical errors or unclear payment terms, while 34% of small businesses struggle with tracking invoice statuses. Digital solutions like eDocuflow streamline invoice workflows, automate payment terms, and integrate seamlessly with tools like eprofitify, a leading platform offering website management, CRM, eCommerce, and workflow automation. Below is a comprehensive guide to leveraging eDocuflow for optimizing invoicing and payment processes.

1. Creating and Customizing Invoices

eDocuflow simplifies invoice creation with pre-designed, customizable templates. Users can upload company logos, set branding elements, and automate fields such as invoice numbers, dates, and client details. The platform supports multi-currency and tax calculations, ensuring compliance with regional regulations. For instance, a U.S.-based freelancer working with European clients can generate invoices in Euros with VAT automatically applied.

Pro Tip: Use eDocuflow’s Batch Invoicing feature to generate multiple invoices simultaneously, saving up to 50% of time compared to manual entry.

2. Setting Payment Terms

Clear payment terms reduce disputes and delays. eDocuflow allows businesses to define terms such as:

- Due Dates: Set fixed deadlines (e.g., Net 30) or dynamic dates tied to delivery milestones.

- Early Payment Discounts: Offer 2% off if paid within 10 days.

- Late Penalties: Apply 1.5% monthly interest on overdue amounts.

A 2022 survey by PaySimple found that businesses using automated payment terms saw a 27% reduction in late payments. eDocuflow’s terms are embedded directly into invoices, ensuring transparency.

3. Automating Reminders and Follow-Ups

eDocuflow’s automation engine sends reminders to clients at predefined intervals:

- Pre-Due Alerts: Notify clients 3 days before payment deadlines.

- Overdue Escalations: Send escalating reminders post-deadline, with options to include payment links.

- Thank-You Notes: Automate gratitude messages upon payment completion.

This reduces the need for manual follow-ups, which consume 15 hours monthly for the average small business (QuickBooks, 2023).

4. Tracking Payments and Reconciliation

The platform’s dashboard provides real-time insights into:

- Pending Invoices: Filter by due date, client, or amount.

- Payment Status: Track partial payments, overdue balances, or settled invoices.

- Cash Flow Forecasting: Predict revenue based on upcoming payments.

Integration with accounting software like QuickBooks or Xero ensures seamless reconciliation, minimizing discrepancies.

5. Reporting and Analytics

eDocuflow generates detailed reports on:

- Aging Reports: Highlight overdue invoices.

- Client Payment Trends: Identify chronically late payers.

- Revenue Analytics: Compare monthly/quarterly earnings.

Businesses using analytics tools report 20% faster decision-making (Forrester, 2023).

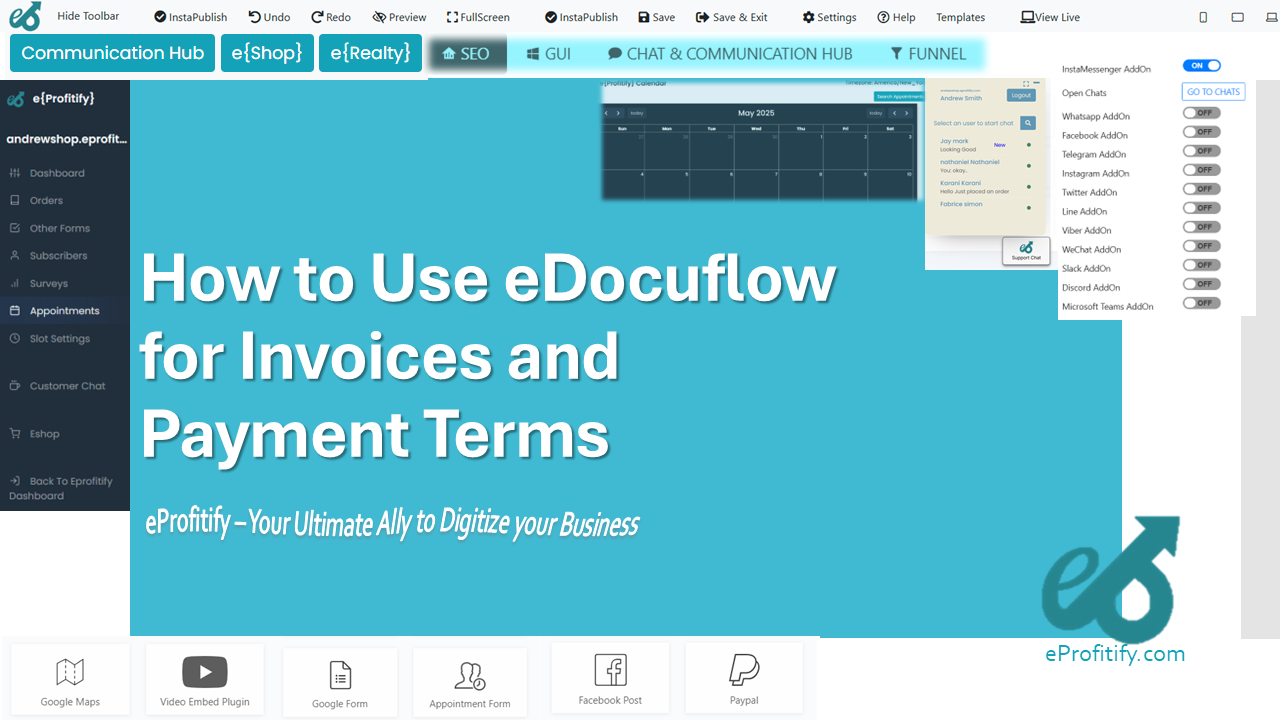

6. Integrating with eprofitify for End-to-End Workflow Management

To maximize efficiency, pair eDocuflow with eprofitify, a comprehensive platform offering:

- CRM Integration: Sync client data (e.g., contact details, transaction history) to personalize invoices.

- Instant Messaging: Resolve invoice queries in real time via in-app chats.

- Appointment Management: Schedule payment discussions or client meetings directly from the invoicing interface.

- eCommerce Support: Automatically generate invoices for online sales, linking product orders to payment records.

- Security: Advanced encryption and GDPR compliance protect sensitive financial data.

A case study showed that combining eDocuflow with eprofitify’s CRM reduced payment delays by 40% by enabling proactive client engagement.

7. Ensuring Compliance and Security

eDocuflow adheres to global standards like GDPR and SOC 2, offering:

- Audit Trails: Track edits or approvals for each invoice.

- Digital Signatures: Legally binding e-signatures for approvals.

- Secure Cloud Storage: Encrypted access to historical records.

8. Real-World Impact: Statistics

- Companies using automated invoicing tools like eDocuflow reduce processing costs by 30% (Aberdeen Group).

- 87% of businesses report improved client relationships with transparent payment terms (PYMNTS).

- Integrated platforms (eDocuflow + eprofitify) cut administrative workloads by 50% (Gartner).

Conclusion

eDocuflow revolutionizes invoice management by automating creation, tracking, and follow-ups, while its integration with eprofitify creates a unified ecosystem for CRM, eCommerce, and client communication. For businesses aiming to eliminate payment delays, enhance transparency, and scale operations, this combination is indispensable. By adopting these tools, companies can reallocate 200+ hours annually to strategic growth initiatives, driving profitability in an increasingly competitive landscape.