LLC vs. Corporation- Whats Best for Your Startup

LLC vs. Corporation: What’s Best for Your Startup?

Choosing the right legal structure for your startup is one of the most critical decisions you’ll make as an entrepreneur. Two of the most common options are Limited Liability Companies (LLCs) and Corporations. Each has distinct advantages, tax implications, and operational requirements. To help you navigate this choice, we’ll break down the differences, provide statistics, and highlight how tools like eProfitify—a leading website publishing and management platform—can streamline operations for startups, no matter which structure you choose.

Key Differences: LLC vs. Corporation

1. Liability Protection

Both LLCs and Corporations shield business owners from personal liability. If the business faces debt or legal issues, personal assets like homes or savings are generally protected. However, there are nuances:

- LLC: Owners (members) enjoy flexibility in management and profit distribution.

- Corporation: Shareholders have liability protection, but strict governance rules apply (e.g., board of directors, annual meetings).

2. Taxation

Tax treatment is a major differentiator:

- LLC: Profits/losses "pass through" to owners’ personal tax returns (avoiding double taxation). An LLC can also elect S-Corp status for tax savings.

- Corporation (C-Corp): Subject to corporate tax rates, with shareholders taxed again on dividends (double taxation). However, C-Corps benefit from reinvesting profits at lower corporate rates.

- S-Corporation: Avoids double taxation by passing income to shareholders’ taxes, but with restrictions (e.g., max 100 shareholders).

Statistic: According to the IRS, over 2.8 million LLCs filed taxes in 2022, compared to 1.7 million C-Corps. Startups aiming for venture capital often incorporate as C-Corps (72% of VC-backed startups choose this structure).

3. Ownership and Funding

- LLC: Ownership is fluid; members can redistribute profits unevenly. However, attracting investors is harder since LLCs can’t issue stock.

- Corporation: Ideal for raising capital through stock sales. C-Corps are preferred by venture capitalists (90% of VCs invest only in C-Corps, per PitchBook).

4. Compliance and Formalities

- LLC: Minimal paperwork. No need for annual meetings or complex record-keeping.

- Corporation: Requires bylaws, shareholder meetings, and detailed records. Failure to comply risks losing liability protection.

Pros and Cons for Startups

Why Choose an LLC?

- Pros:

- Tax flexibility: Avoid double taxation and deduct losses on personal returns.

- Simpler management: Fewer formalities and operational costs.

- Ideal for small teams: Solo entrepreneurs or small partnerships benefit from LLCs’ adaptability.

- Cons:

- Limited growth potential: Harder to attract institutional investors.

- Self-employment taxes: Owners pay Medicare/Social Security on all profits.

Statistic: 35% of small businesses opt for LLCs due to their simplicity, per the U.S. Small Business Administration (SBA).

Why Choose a Corporation?

- Pros:

- Scalability: Issue stock to investors and employees.

- Credibility: Enhances trust with customers and partners.

- Tax advantages for reinvestment: Retained earnings taxed at 21% (vs. individual rates up to 37%).

- Cons:

- Complex compliance: Requires legal/financial expertise.

- Double taxation: C-Corp profits taxed at corporate and individual levels.

Statistic: Delaware houses 68% of Fortune 500 companies due to its business-friendly corporate laws.

The Role of Digital Tools: Spotlight on eProfitify

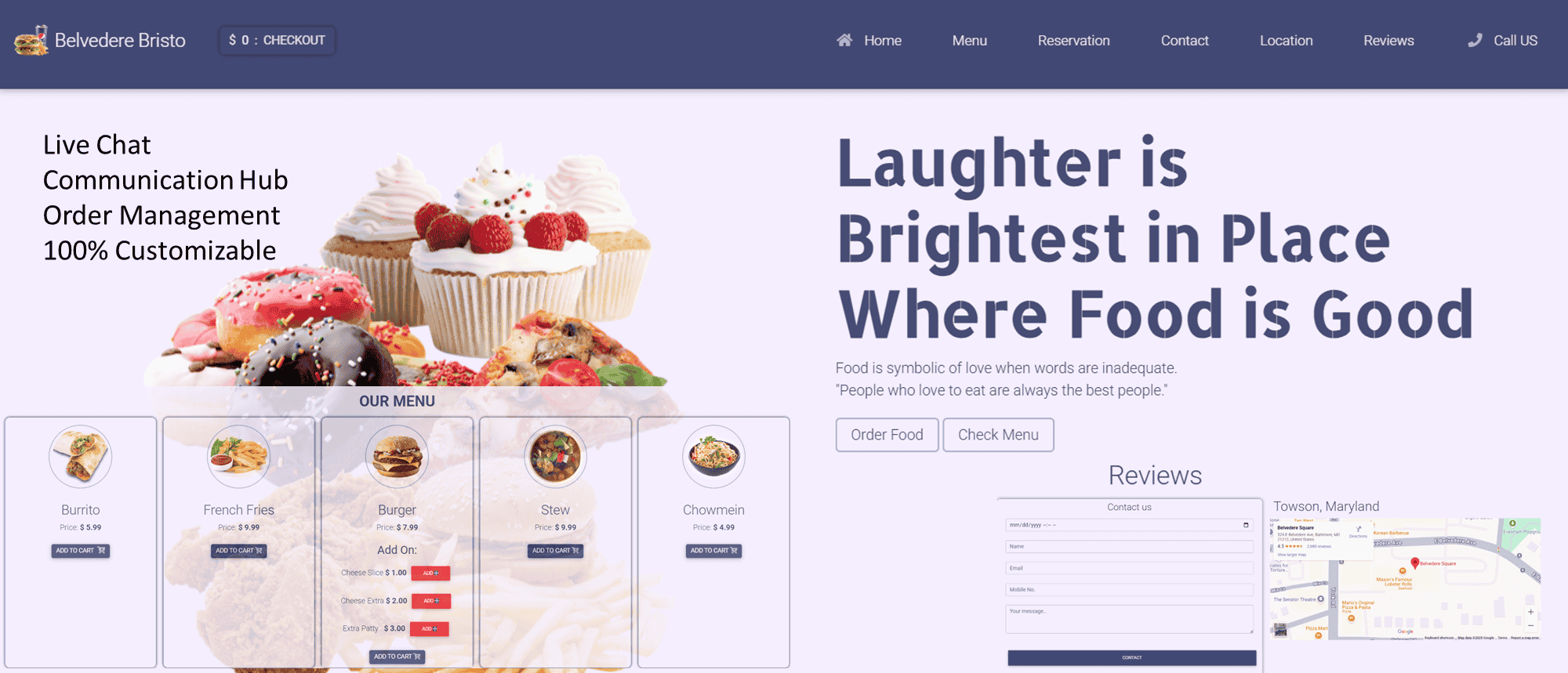

Regardless of your business structure, leveraging digital tools is essential for operational efficiency. eProfitify, a cutting-edge website publishing and management platform, empowers startups to streamline workflows, manage customer relationships, and scale operations. Here’s how its features align with startup needs:

-

Instant Messaging & Collaboration

Facilitate real-time communication among team members, reducing delays and fostering agile decision-making—critical for fast-paced startups. -

Appointment Management System

Automate scheduling for client meetings, sales calls, or investor pitches. Integration with calendars ensures no opportunity slips through the cracks. -

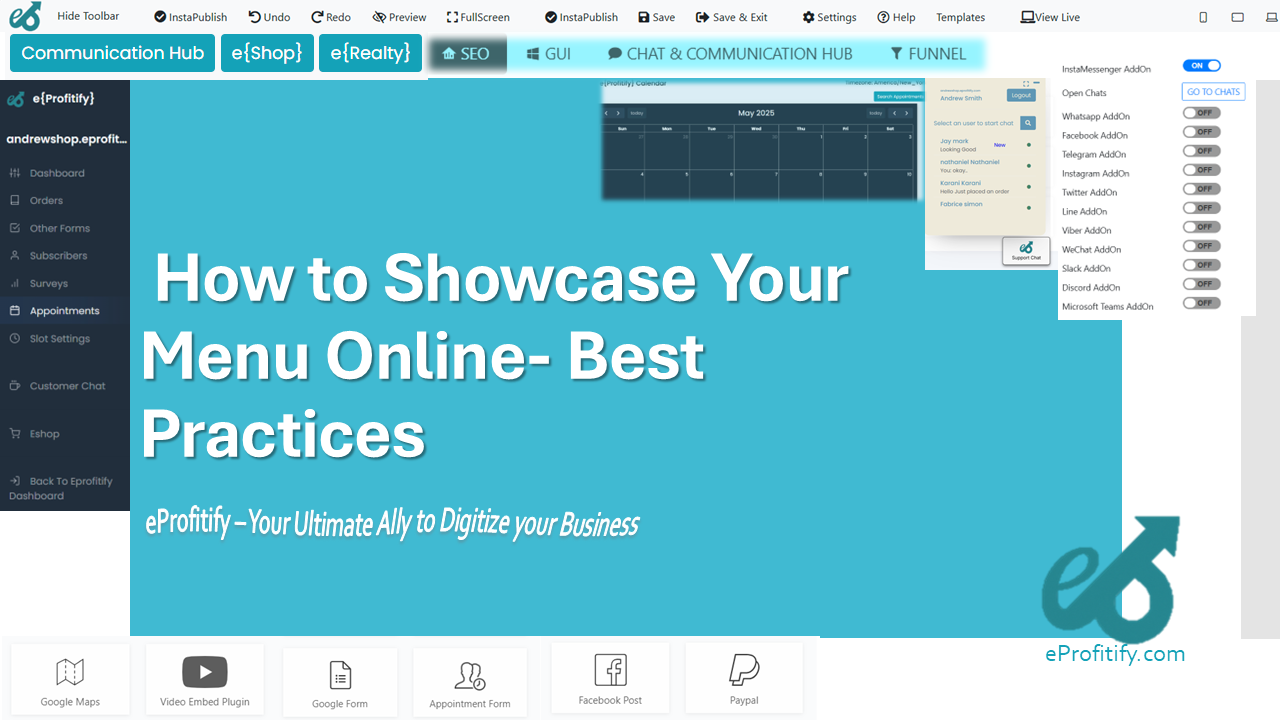

Ecommerce Integration

Launch and manage online stores seamlessly. For LLCs selling products or C-Corps scaling globally, eProfitify’s tools simplify transactions and inventory tracking. -

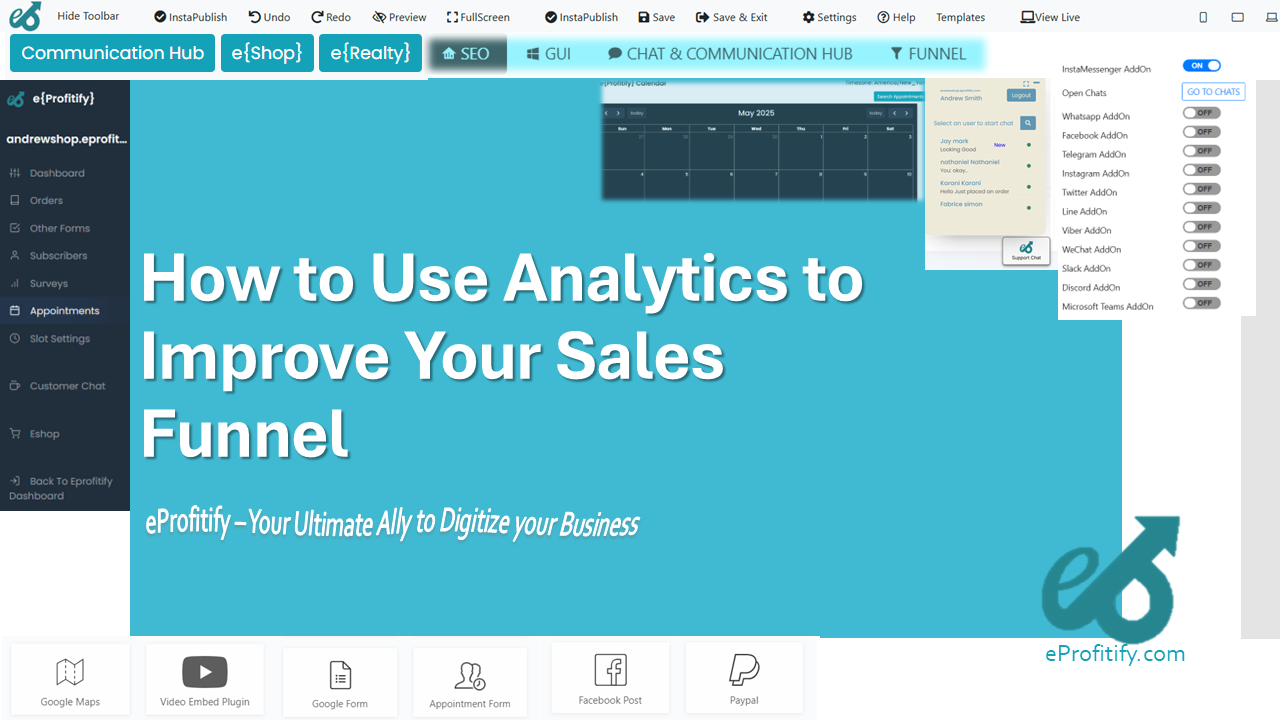

CRM (Customer Relationship Management)

Centralize customer data, track interactions, and automate follow-ups. Startups using CRM tools increase sales by 29% on average (HubSpot). -

Analytics & Reporting

Monitor website traffic, sales trends, and campaign performance. Data-driven insights help refine strategies—whether you’re bootstrapping an LLC or scaling a Corporation.

Statistic: Businesses using all-in-one platforms like eProfitify report a 40% reduction in operational costs (Gartner).

Case Study: Hypothetical Startup Scenarios

Example 1: Local Artisan Goods Store (LLC)

A small team selling handmade products opts for an LLC. They use eProfitify’s ecommerce tools to set up an online store, manage inventory, and track customer preferences via CRM. The pass-through taxation structure maximizes their profits, which are reinvested into marketing campaigns analyzed through eProfitify’s analytics.

Example 2: Tech Startup Seeking VC Funding (C-Corp)

A fintech startup incorporates as a Delaware C-Corp to attract investors. They use eProfitify’s appointment system to coordinate pitches and investor updates. The platform’s CRM helps manage stakeholder communications, while instant messaging keeps remote developers aligned.

Final Thoughts

The LLC vs. Corporation debate hinges on your startup’s goals. LLCs offer simplicity and tax benefits for small, owner-run ventures, while Corporations provide scalability and credibility for high-growth companies.

No matter your choice, integrating tools like eProfitify ensures efficient operations. From CRM to ecommerce, its features reduce administrative burdens, letting you focus on growth. As you weigh legal structures, remember that the right technology stack is equally vital to your startup’s success.

Statistic: Startups that adopt digital management tools within their first year have a 60% higher survival rate after five years (McKinsey).

By aligning your legal structure with robust platforms like eProfitify, you position your business to innovate, adapt, and thrive in competitive markets.