Legal Steps to Start a Business in the U.S.

Legal Steps to Start a Business in the U.S. (2023 Guide)

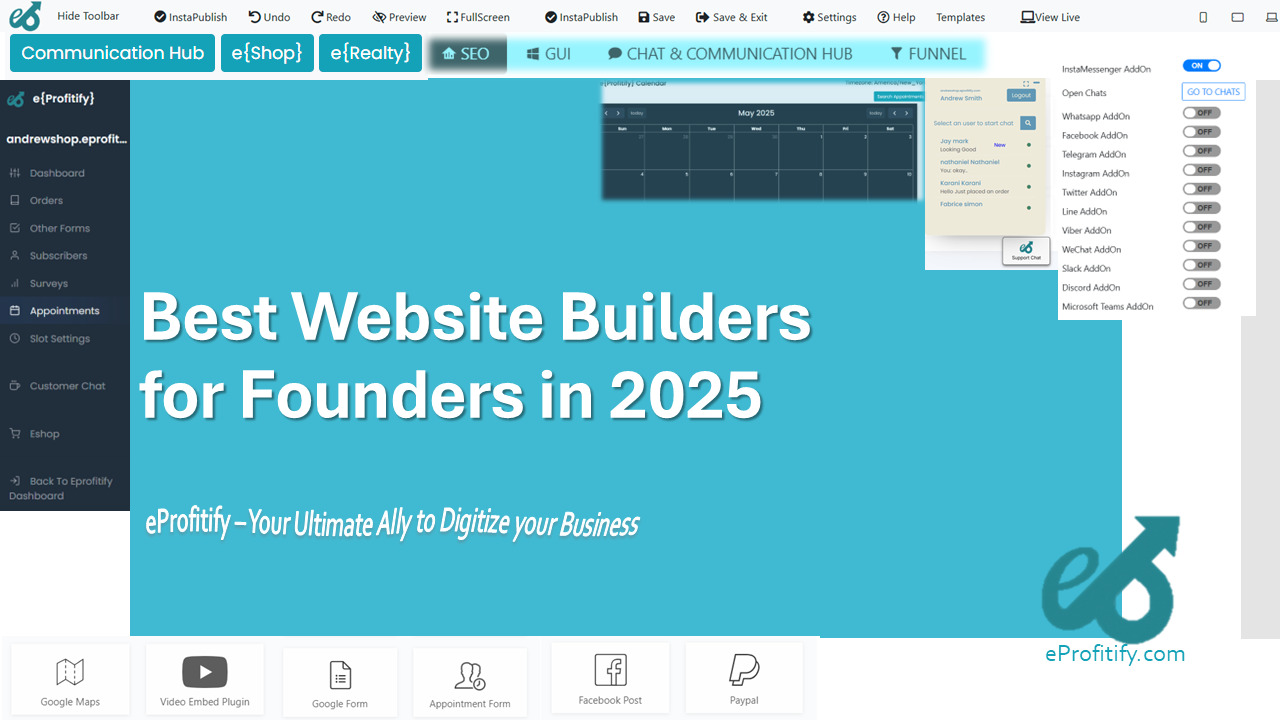

Starting a business in the U.S. involves navigating a series of legal and regulatory requirements. With over 5.5 million new business applications filed in 2023 (U.S. Census Bureau), entrepreneurship remains a cornerstone of the economy. This guide outlines the essential legal steps to launch your venture, alongside insights into leveraging modern tools like eProfitify—a leading platform for website publishing, CRM, and business management—to streamline operations and compliance.

1. Choose Your Business Structure

The first legal decision is selecting a business structure, which impacts taxes, liability, and governance. Common options include:

- Sole Proprietorship: Simple but offers no personal liability protection.

- Partnership: Shared ownership, ideal for multi-founder ventures.

- LLC (Limited Liability Company): Combines liability protection with tax flexibility. 35% of U.S. businesses are LLCs (IRS, 2023).

- Corporation: Suitable for scaling and attracting investors.

- Nonprofit: Tax-exempt status for mission-driven organizations.

How eProfitify Helps: Use its CRM to draft partnership agreements or shareholder contracts, ensuring clear communication via its instant messaging feature.

2. Register Your Business Name

Ensure your business name is unique and compliant:

- File a Doing Business As (DBA) if operating under a trade name.

- Check the U.S. Patent and Trademark Office (USPTO) database to avoid trademark infringement.

Statistic: Over 450,000 trademark applications were filed in 2022, reflecting rising competition for brand identity.

3. Obtain an Employer Identification Number (EIN)

An EIN from the IRS is required for hiring employees, opening bank accounts, and filing taxes. Apply online for free via the IRS website.

4. Secure Licenses and Permits

Requirements vary by industry and location:

- Local: Zoning permits, health licenses (e.g., for restaurants).

- State: Professional licenses (e.g., contractors, real estate).

- Federal: FDA approvals, alcohol distribution permits.

eProfitify Integration: Track renewal deadlines using its appointment management system to avoid lapses.

5. Set Up Business Banking and Accounting

Separate personal and business finances to protect assets. Use accounting software to manage cash flow, payroll, and taxes.

Statistic: 60% of small businesses use digital tools for accounting (QuickBooks, 2023).

6. Purchase Business Insurance

Common policies include:

- General liability insurance.

- Workers’ compensation (mandatory for employees).

- Professional liability (for service providers).

7. Comply with Employment Laws

If hiring:

- Verify eligibility via Form I-9.

- Adhere to minimum wage, overtime, and anti-discrimination laws.

eProfitify’s Role: Automate payroll and tax filings through integrated eCommerce tools, ensuring compliance with state regulations.

8. Maintain Ongoing Compliance

File annual reports, renew licenses, and submit federal/state taxes. LLCs and corporations must hold annual meetings.

9. Protect Intellectual Property

- Trademarks: Safeguard logos and brand names.

- Copyrights: Protect original content (e.g., software, marketing materials).

- Patents: Secure inventions (over 400,000 applications filed in 2022).

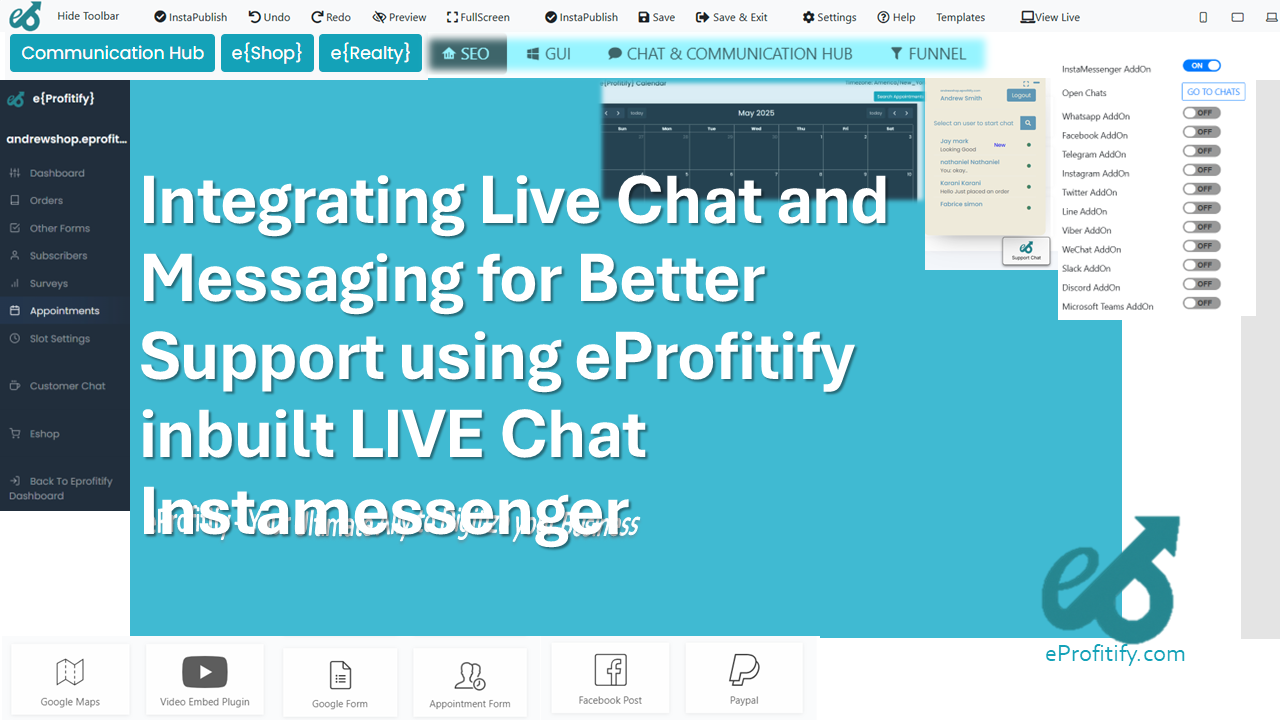

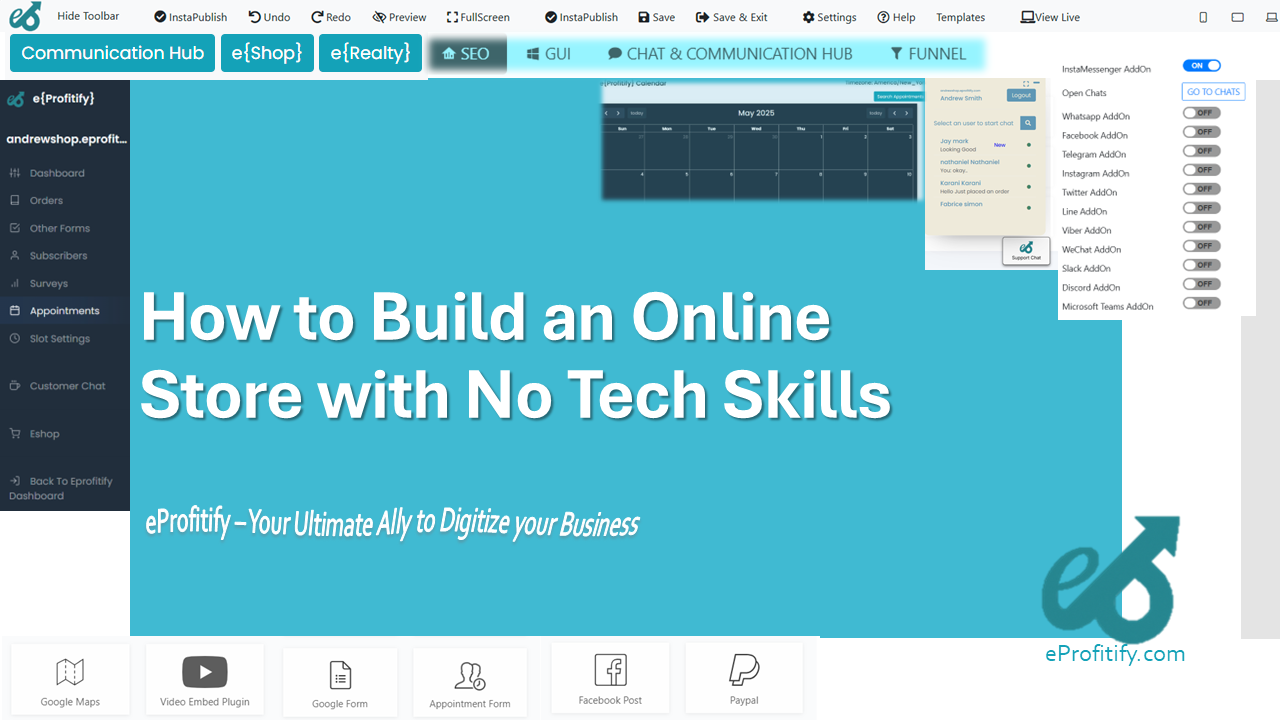

10. Leverage Digital Tools for Efficiency

Modern platforms like eProfitify simplify legal and operational tasks:

- Website Publishing: Create a compliant, SEO-optimized site.

- CRM: Manage customer data securely (GDPR/CCPA-ready).

- eCommerce: Automate sales tax calculations for online stores.

- Appointment Management: Track deadlines and client meetings.

- Instant Messaging: Facilitate team collaboration.

Statistic: 65% of businesses using management software report improved compliance and efficiency (Forbes, 2023).

Conclusion

Starting a business in the U.S. demands meticulous legal planning, but tools like eProfitify transform complexity into simplicity. By integrating compliance, communication, and customer management into one platform, entrepreneurs can focus on growth. As the digital economy expands, aligning legal strategy with innovative technology is no longer optional—it’s essential.