Streamline insurance policy agreements with eDocuflow by eProfitify

Schedule a LIVE Zoom call with an eProfitify Expert.

Streamlining Insurance Policy Agreements with eDocuflow by eProfitify

The insurance industry is built on precision, compliance, and timely communication. Policy agreements form the backbone of this sector, outlining terms, conditions, and obligations between insurers and policyholders. However, traditional methods of creating, managing, and distributing these documents are often manual, time-consuming, and prone to errors. eProfitify’s eDocuflow addresses these challenges by offering a tailored document generation solution designed to automate and streamline insurance policy agreements. This tool empowers insurance providers to enhance efficiency, reduce administrative burdens, and deliver a seamless experience for both teams and clients.

Challenges in Traditional Insurance Documentation

Insurance companies routinely handle complex policy agreements that require meticulous attention to detail. Legacy processes often involve manually drafting documents, which is labor-intensive and increases the risk of inconsistencies or inaccuracies. Key pain points include:

- Time-Creation Processes: Manually inputting client data, policy terms, and regulatory clauses delays turnaround times.

- Compliance Risks: Keeping documents aligned with ever-evolving regulations demands constant vigilance. A single oversight can lead to legal or financial repercussions.

- Version Control Issues: Multiple stakeholders reviewing and editing documents can result in conflicting versions, causing confusion and errors.

- Scalability Limitations: As client bases grow, manually generating customized policies becomes unsustainable.

eDocuflow tackles these challenges head-on by automating document workflows, ensuring accuracy, and integrating seamlessly with existing systems.

eDocuflow: A Modern Solution for Insurance Documentation

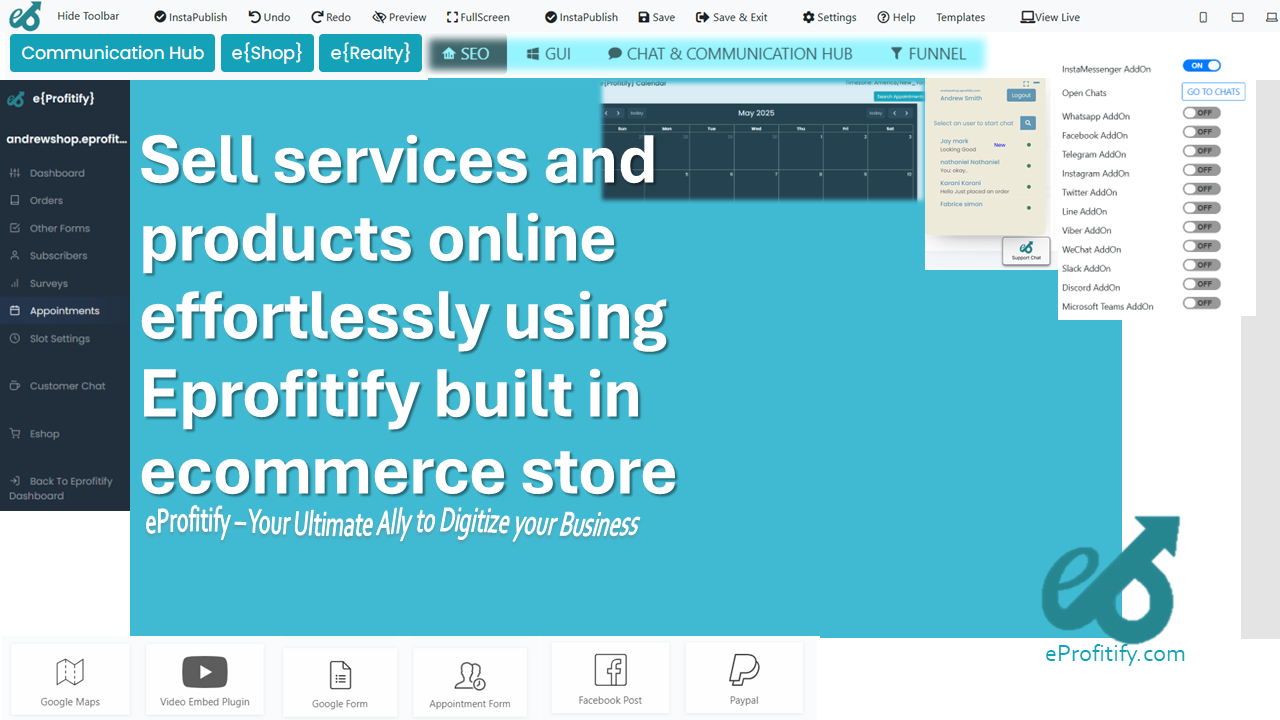

eDocuflow is a customizable document generation platform that simplifies the creation, management, and distribution of insurance policies. By leveraging automation, collaboration tools, and compliance safeguards, it transforms how insurers handle critical agreements.

Key Features of eDocuflow for Insurance Providers

-

Pre-Built, Customizable Templates

eDocuflow offers a library of pre-designed templates tailored to various insurance products, such as auto, health, life, or property insurance. These templates are fully customizable, allowing companies to align documents with their branding and specific policy structures. Users can dynamically insert client-specific data—like names, coverage limits, and premiums—directly into templates, eliminating manual entry. -

Real-Time Collaboration and Approval Workflows

Insurance policies often require input from underwriters, legal teams, and agents. eDocuflow’s collaboration tools enable stakeholders to review, annotate, and approve documents in real time. Version control ensures everyone works on the latest draft, while audit trails provide transparency into edits and approvals. This feature minimizes delays and ensures accountability. -

Automated Compliance Checks

Regulatory compliance is non-negotiable in insurance. eDocuflow integrates compliance checks into the document creation process, automatically updating clauses to reflect current laws and industry standards. This reduces the risk of non-compliance and safeguards against penalties or disputes. -

Seamless Integration with Existing Systems

eDocuflow integrates with CRMs, databases, and other tools commonly used by insurers. For instance, client data from eProfitify’s CRM can auto-populate policy agreements, while integration with eRealty (eProfitify’s real estate module) streamlines property insurance documentation. This interoperability eliminates silos and ensures data consistency across platforms. -

Secure Document Storage and Sharing

Insurance policies contain sensitive information, making security a priority. eDocuflow encrypts documents during storage and transmission, with role-based access controls to restrict unauthorized viewing. Insurers can securely share finalized policies via email or client portals, enhancing trust and professionalism. -

E-Signature Capabilities

The platform supports e-signature integration, allowing policyholders to sign agreements digitally. This accelerates the approval process, reduces paperwork, and enables faster policy activation.

Benefits of eDocuflow for Insurance Workflows

- Faster Turnaround Times: Automation slashes the time spent drafting policies, enabling insurers to serve clients more efficiently.

- Error Reduction: Pre-filled templates and automated data pulls minimize manual entry, reducing typographical or formatting errors.

- Enhanced Compliance: Automated updates keep policies aligned with regulations, mitigating legal risks.

- Improved Client Experience: Quick, accurate policy issuance and digital signing improve client satisfaction.

- Scalability: The system handles increasing volumes of policies without requiring additional staffing.

Use Cases for Insurance Providers

-

Auto Insurance Policy Generation

Agents can generate customized auto insurance policies by inputting driver details, vehicle information, and coverage options into eDocuflow. The system auto-generates a polished document, which is then reviewed and sent for e-signature, reducing processing time from days to hours. -

Health Insurance Policy Management

Health insurers deal with complex agreements involving multiple beneficiaries and coverage tiers. eDocuflow’s dynamic templates adapt to varying scenarios, ensuring clarity and compliance while simplifying updates during renewals or plan changes. -

Property Insurance for Real Estate

Integration with eRealty allows property insurers to pull data directly from real estate listings or client portfolios. Policies are generated with accurate property details, risk assessments, and coverage terms, streamlining workflows for agents and brokers. -

Claims Documentation

Beyond policy creation, eDocuflow assists in generating claims forms and settlement agreements. Automated workflows ensure timely processing and consistent communication with policyholders.

Conclusion

eDocuflow by eProfitify redefines how insurance companies manage policy agreements. By automating document generation, enforcing compliance, and fostering collaboration, the platform empowers insurers to operate with greater accuracy and efficiency. In an industry where trust and precision are paramount, eDocuflow provides the tools needed to reduce administrative overhead, mitigate risks, and deliver exceptional service to policyholders. As insurance demands grow increasingly complex, adopting a solution like eDocuflow ensures organizations stay agile, competitive, and client-focused in a rapidly evolving market.