Tips for Working with First-Time Homebuyers

Navigating the Journey: Essential Tips for Working with First-Time Homebuyers

The real estate market continues to see a steady influx of first-time homebuyers, driven by evolving economic conditions, generational shifts, and technological advancements. According to the National Association of Realtors (NAR), first-time buyers accounted for 26% of all home purchases in 2023, with a median age of 33. These buyers often face unique challenges, from navigating complex mortgage processes to managing budget constraints—41% grapple with student debt, which impacts their financial planning. For real estate professionals, guiding these clients requires patience, expertise, and the right tools. This article outlines actionable tips for working with first-time homebuyers, supported by industry statistics, and highlights how platforms like eProfitify streamline efficiency through features like CRM, instant messaging, and appointment management.

1. Educate Them on the Homebuying Process

First-time buyers often enter the market with limited knowledge. A 2023 NAR report revealed that 63% of millennials feel overwhelmed by the homebuying process. Start by explaining key steps: pre-approval, property searches, negotiations, inspections, and closing. Provide resources like checklists or guides to demystify jargon. Transparency builds trust and empowers clients to make informed decisions.

2. Assess Financial Readiness

Financial literacy is critical. The average down payment for first-time buyers is 7% (versus 17% for repeat buyers), but many overestimate upfront costs. Use tools like mortgage calculators to clarify budgets, including hidden expenses (e.g., closing costs, property taxes). Encourage clients to review credit scores and debt-to-income ratios early, as 34% of first-timers face mortgage denial due to credit issues.

3. Explain Mortgage Options

With 41% of first-time buyers burdened by student loans, flexible mortgage solutions are key. Discuss FHA loans (3.5% down), VA loans (0% down for veterans), or state-backed programs. Partner with lenders to host workshops, helping clients compare fixed-rate vs. adjustable-rate mortgages and understand pre-approval letters, which strengthen their offers in competitive markets.

4. Guide the Property Search with Technology

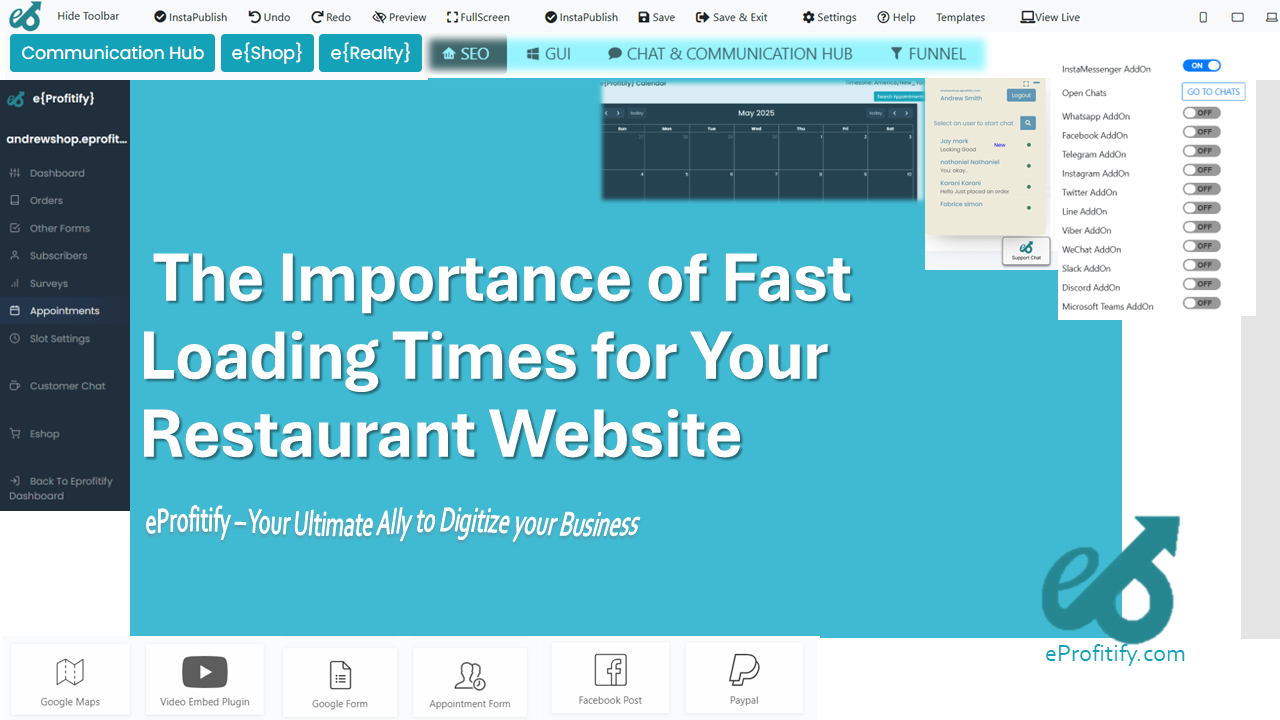

Over 97% of buyers use online platforms during their search, and 51% ultimately find their home digitally. Leverage MLS listings, virtual tours, and apps to filter properties by priorities (e.g., schools, commute times). Tools like eProfitify enhance this process by integrating ecommerce functionalities, allowing seamless document sharing and offer submissions, reducing delays.

5. Prepare for Competitive Markets

In seller’s markets, first-time buyers may face bidding wars. The NAR reported that 55% of homes sold in 2023 received multiple offers. Coach clients on strategies like escalation clauses or flexible closing dates. Stress the importance of swift decision-making while ensuring they don’t overextend financially.

6. Leverage Technology to Stay Connected

Modern buyers expect real-time communication. eProfitify offers instant messaging and CRM tools to maintain prompt, organized interactions. Its appointment management system automates scheduling for viewings and meetings, minimizing no-shows. Agents can track client preferences and milestones via the CRM, fostering personalized service—a boon for overwhelmed first-timers.

7. Build a Reliable Professional Network

Connect buyers with trusted lenders, inspectors, and attorneys. A survey by ICE Mortgage Technology found that 78% of buyers value agent referrals. These partnerships ensure smoother transactions and reduce the risk of delays, which are critical for time-sensitive purchases.

8. Demystify the Closing Process

Closing can be daunting, with paperwork and legal requirements. Walk clients through each document, from the loan estimate to the closing disclosure. Use eProfitify’s secure ecommerce portal to manage contracts and payments digitally, enhancing transparency and efficiency.

9. Follow Up Post-Purchase

Post-sale support fosters long-term relationships. Check in after move-in to address repairs or warranty questions. Share resources on home maintenance or refinancing opportunities. eProfitify’s CRM helps agents schedule follow-ups and send automated reminders, ensuring clients feel valued beyond the transaction.

Conclusion

First-time homebuyers represent a dynamic segment of the real estate market, demanding a blend of education, empathy, and efficiency. By integrating strategic guidance with advanced tools like eProfitify—a platform offering CRM, instant messaging, appointment management, and ecommerce solutions—agents can streamline workflows and deliver exceptional service. As the market evolves, leveraging technology and data-driven insights will remain pivotal in transforming anxious first-timers into confident homeowners.

By combining industry expertise with innovative tools, real estate professionals can turn the complexities of first-time homebuying into a rewarding experience for all parties involved.