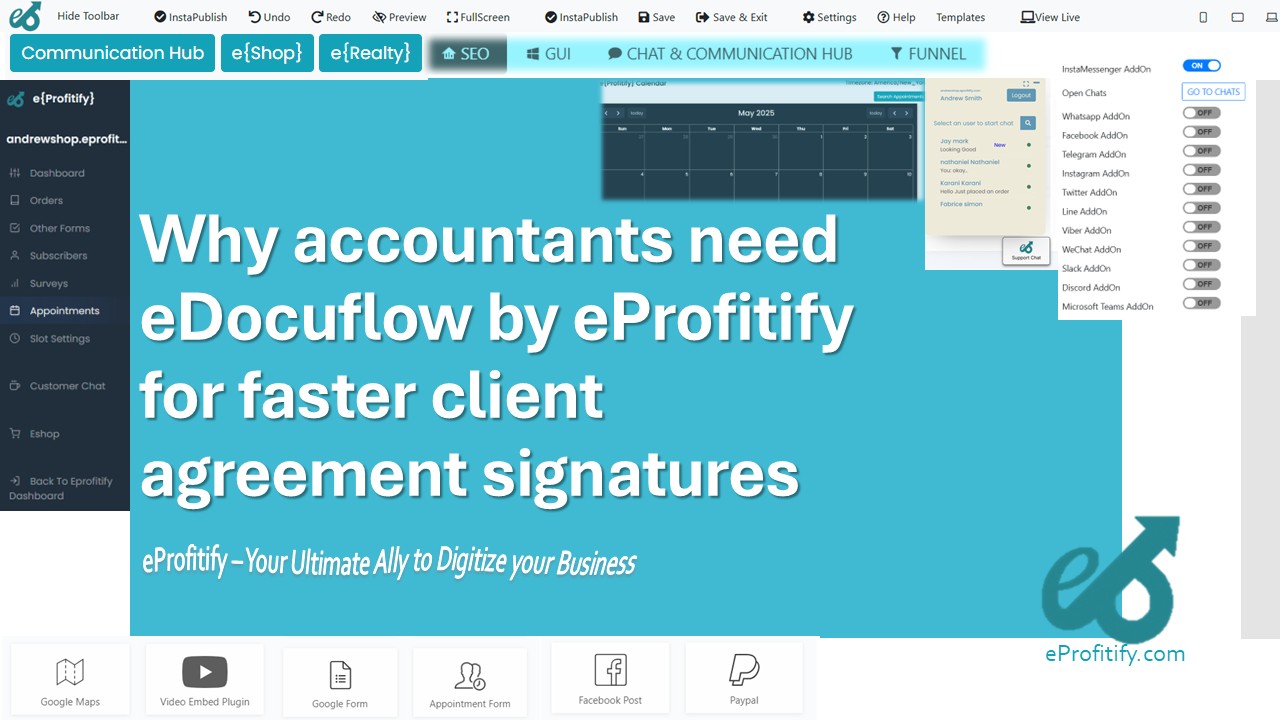

Why accountants need eDocuflow by eProfitify for faster client agreement signatures

Schedule a LIVE Zoom call with an eProfitify Expert.

Why Accountants Need eDocuflow by eProfitify for Faster Client Agreement Signatures

In the fast-paced world of accounting, efficiency and accuracy are non-negotiable. Accountants juggle multiple responsibilities, from tax preparation to financial advisory services, all while ensuring compliance with ever-evolving regulations. One critical yet often time-consuming task is managing client agreements. Traditional methods of drafting, sharing, and securing signatures on documents like engagement letters, tax filings, or consultancy contracts can create bottlenecks, delaying workflows and straining client relationships. eDocuflow, a customized document generator integrated into the eProfitify platform, addresses these challenges by streamlining the entire agreement lifecycle. This tool empowers accountants to accelerate client signature processes, reduce administrative burdens, and focus on higher-value tasks. Here’s why eDocuflow is indispensable for modern accounting professionals.

The Burden of Manual Document Management

Accountants traditionally rely on manual processes to create, review, and finalize client agreements. Drafting documents from scratch or modifying templates requires meticulous attention to detail to avoid errors that could lead to compliance issues or disputes. Once a document is prepared, it must be shared with clients via email or physical copies, followed by back-and-forth communication to address revisions. Securing signatures often involves printing, scanning, or relying on disjointed e-signature tools, which disrupts workflow continuity. Delays in obtaining signatures can stall projects, delay billing cycles, and create frustration for both accountants and clients.

eDocuflow eliminates these inefficiencies by automating document creation and signature workflows within a unified platform.

How eDocuflow Transforms Document Workflows

eDocuflow is designed to simplify document management through features tailored to the needs of accounting professionals. Below are key functionalities that make it a game-changer:

1. Customizable Templates

eDocuflow offers a library of pre-built templates for common accounting documents, including engagement letters, non-disclosure agreements (NDAs), and service contracts. These templates are fully customizable, allowing accountants to add client-specific details, clauses, or branding elements in seconds. By reducing repetitive data entry, templates minimize the risk of errors and ensure consistency across documents.

2. Seamless E-Signature Integration

The tool integrates electronic signature capabilities directly into the document workflow. Once a document is ready, accountants can send it to clients via a secure link. Clients can review and sign agreements digitally from any device, eliminating the need for printing, scanning, or in-person meetings. eDocuflow supports multi-party signing, enabling stakeholders to sign sequentially or simultaneously, further accelerating turnaround times.

3. Automated Reminders and Notifications

Clients often overlook or delay reviewing agreements, leading to bottlenecks. eDocuflow automatically sends reminders to clients about pending signatures, reducing follow-up efforts for accountants. Notifications also alert users when a document is viewed, signed, or requires action, ensuring transparency throughout the process.

4. Centralized Document Storage

All agreements are securely stored in a cloud-based repository within eProfitify’s platform. Accountants can quickly retrieve past documents, track version histories, and audit trails, which is critical for compliance and dispute resolution. This centralized system eliminates the risk of misplaced files and ensures data integrity.

5. Collaboration Tools

eDocuflow enables real-time collaboration between accountants, clients, and legal teams. Comments, edits, and approvals can be managed within the platform, reducing reliance on fragmented email threads. This feature is particularly valuable for complex agreements requiring input from multiple stakeholders.

6. Compliance and Security

eDocuflow adheres to industry-standard security protocols, including encryption and access controls, to protect sensitive client data. The platform complies with regulations such as GDPR and IRS e-signature guidelines, ensuring that digitally signed agreements are legally binding and audit-ready.

Benefits for Accountants

By integrating eDocuflow into their workflows, accountants gain tangible advantages:

- Faster Turnaround Times: Automated templates and e-signatures cut document processing time from days to minutes, enabling quicker project kickoffs and revenue recognition.

- Reduced Administrative Overhead: Less time spent on manual tasks allows accountants to focus on strategic activities like tax planning or client advisory services.

- Enhanced Client Experience: Clients appreciate the convenience of digital signing and real-time updates, which strengthens trust and satisfaction.

- Lower Risk of Errors: Pre-approved templates and automated fields minimize manual data entry mistakes that could lead to compliance penalties or rework.

- Scalability: eDocuflow supports firms of all sizes, from solo practitioners to large practices, adapting to growing client bases without added complexity.

Real-World Applications in Accounting

eDocuflow’s versatility makes it applicable across various accounting scenarios:

- Tax Season Efficiency: During peak periods, accountants can rapidly generate and distribute engagement letters or extension requests, ensuring deadlines are met.

- Advisory Services: For firms offering consultancy, eDocuflow simplifies the creation of customized proposals and service agreements, reinforcing professionalism.

- Audit Preparedness: Secure storage and audit trails help firms quickly retrieve documents during internal or regulatory reviews.

Integration with eProfitify’s Ecosystem

eDocuflow is part of eProfitify’s comprehensive suite of tools, which includes CRM, appointment scheduling, and AdOrbit for ad management. This integration allows accountants to sync client data from the CRM directly into documents, track client interactions, and manage workflows end-to-end within a single platform. For example, after signing an agreement via eDocuflow, the CRM can automatically schedule follow-up meetings or trigger invoice generation through eProfitify’s ecommerce module.

Conclusion

In an industry where time is money, eDocuflow by eProfitify equips accountants with the tools to modernize document management and signature processes. By automating repetitive tasks, enhancing collaboration, and ensuring compliance, the platform enables professionals to deliver faster, more reliable services while building stronger client relationships. For accounting firms aiming to stay competitive in a digital-first world, adopting eDocuflow is not just a convenience—it’s a strategic necessity.

![The Story Behind [Successful Food Truck Name] and Their Digital Marketing Strategy](../img/The Story Behind Successful Food Truck Name and Their Digital Marketing Strategy.png)