Integrating Payment Gateways on Your Website

Integrating Payment Gateways on Your Website: A Strategic Guide for Modern Businesses

The digital economy is booming, with global e-commerce sales projected to surpass $6.3 trillion in 2024 (Statista, 2023). As businesses strive to capitalize on this growth, integrating seamless payment solutions into their websites has become non-negotiable. Payment gateways act as the bridge between online transactions and revenue, ensuring secure, efficient, and flexible payment processing. In this guide, we’ll explore the essentials of payment gateway integration, industry trends, and how platforms like eProfitify—a leading website publishing and management tool—simplify this process while enhancing customer experience.

Why Payment Gateway Integration Matters

A payment gateway is a technology that authorizes credit card or digital payments for online businesses, encrypting sensitive data to ensure secure transactions. With 77% of global consumers preferring online shopping (McKinsey, 2023), failing to offer a smooth checkout experience can cost businesses dearly. Consider these statistics:

- 17% of cart abandonments occur due to a lack of preferred payment methods (Baymard Institute, 2023).

- 56% of shoppers prioritize security as their top concern when paying online (PwC, 2023).

Integrating a reliable payment gateway not only reduces cart abandonment but also builds trust, expands global reach (via multi-currency support), and automates financial workflows.

Choosing the Right Payment Gateway: Key Considerations

Not all payment gateways are created equal. Here’s what to evaluate:

- Security & Compliance: Ensure PCI-DSS compliance and SSL encryption.

- Transaction Fees: Compare processing fees (typically 2–3% + fixed charges per transaction).

- Supported Currencies and Methods: Offer popular options like credit/debit cards, digital wallets (e.g., Apple Pay, Google Pay), and Buy Now, Pay Later (BNPL) services, which account for 25% of global e-commerce spend (Worldpay, 2023).

- Integration Complexity: Some gateways, like Stripe and PayPal, offer developer-friendly APIs, while platforms like eProfitify streamline integration through pre-built modules.

Popular gateways include Stripe (used by 3.1 million sites), PayPal (430 million active accounts), and Square, but the best choice depends on your business size and audience.

Steps to Integrate a Payment Gateway

- Select a Gateway: Match your needs to provider features.

- Set Up a Merchant Account: This holds funds before transferring to your bank.

- API Integration: Developers connect the gateway to your site via APIs. Alternatively, use no-code platforms like eProfitify to automate this step.

- Test Transactions: Simulate purchases to ensure functionality.

- Go Live: Monitor transactions and optimize for UX.

For non-technical users, platforms offering built-in payment solutions are invaluable.

Emerging Trends in Payment Processing

- Mobile Wallets: Mobile payments will account for 54% of e-commerce sales by 2025 (eMarketer).

- Cryptocurrency: 12% of Americans have used crypto for purchases (Pew Research, 2023).

- Omnichannel Payments: Unify online/in-store experiences—67% of retailers now prioritize this (Salesforce).

- AI-Driven Fraud Detection: Reduces chargebacks by analyzing transaction patterns.

Businesses must adapt to these trends to stay competitive.

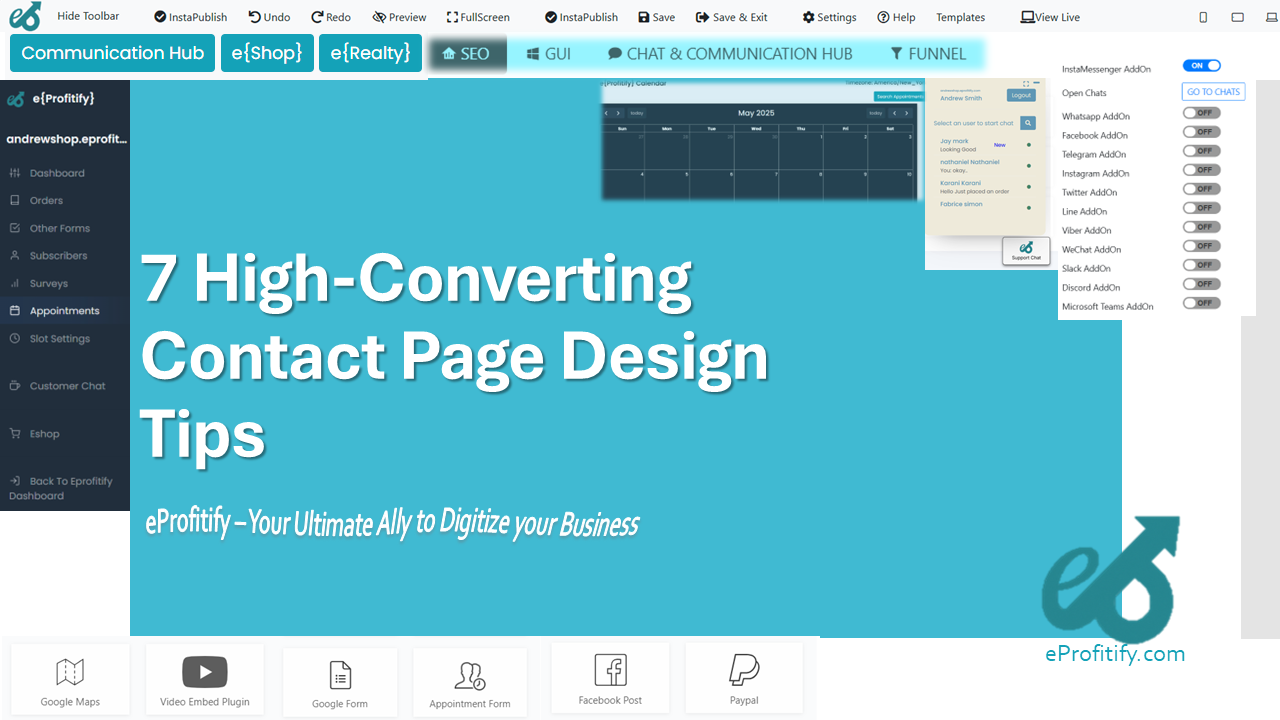

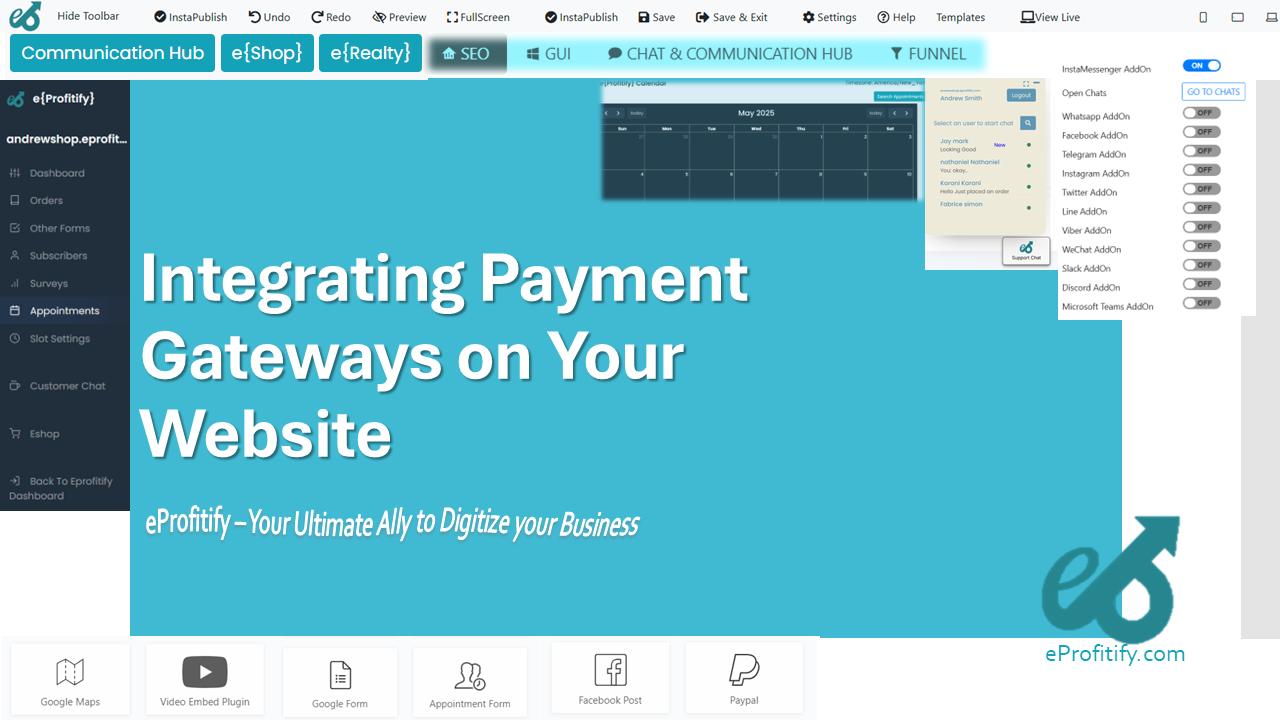

eProfitify: Empowering Businesses Beyond Payments

While payment gateways are critical, managing them alongside other operational tools can be cumbersome. This is where eProfitify shines—a comprehensive website management platform that integrates payment processing with tools to streamline your entire business:

-

Effortless Gateway Integration

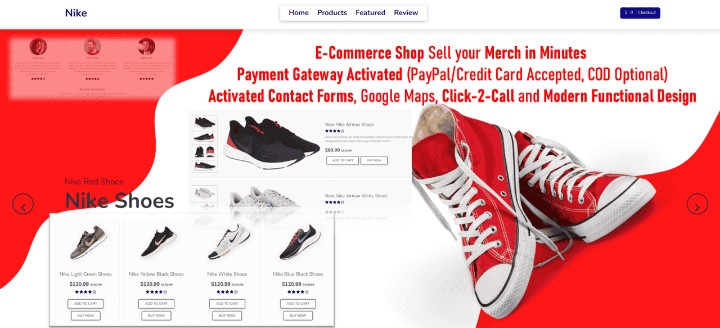

eProfitify supports major gateways (Stripe, PayPal, etc.), enabling quick setup without coding. Merchants can activate multiple payment methods in minutes, ensuring customers never face checkout friction. -

Unified CRM

Sync transaction data with customer profiles to track purchase histories, preferences, and behavior. Automate personalized marketing campaigns, boosting repeat sales. -

E-commerce Tools

Manage inventory, create product catalogs, and run promotions—all integrated with your payment system. -

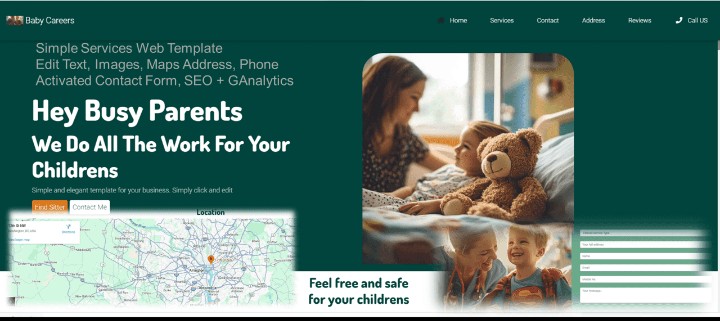

Appointment Management

Ideal for service-based businesses, this feature lets clients book and pay seamlessly. -

Instant Messaging

Engage customers in real-time via chatbots or live chat, resolving queries before they abandon carts. -

Analytics Dashboard

Track sales trends, gateway performance, and customer metrics in one place.

Businesses using all-in-one platforms like eProfitify report 30% higher conversion rates (Gartner, 2023) due to cohesive workflows and enhanced user experiences.

Why Payment Integration Alone Isn’t Enough

Success in e-commerce hinges on more than just accepting payments. For example, a customer who pays via a mobile wallet might expect instant post-purchase support via chat or automated follow-ups through CRM. eProfitify bridges these gaps by unifying payment processing with communication and management tools, turning transactions into long-term relationships.

Conclusion

Integrating a payment gateway is a strategic move that directly impacts revenue and customer satisfaction. Yet, in a competitive digital landscape, businesses need holistic solutions that combine payments with CRM, e-commerce, and engagement tools. Platforms like eProfitify not only simplify gateway integration but also empower businesses to deliver end-to-end excellence—from the first click to the final payment. As online sales continue to soar, embracing such tools isn’t just wise; it’s essential for sustainable growth.

By leveraging eProfitify’s suite of features, businesses can focus on scaling while the platform handles the complexities of modern digital commerce. Explore how integrating the right payment gateway with a robust management system can transform your website into a powerhouse of efficiency and profitability.