What Are the Legal Requirements for Operating a Food Truck in Your City

Schedule a LIVE Zoom call with an eProfitify Expert.

Navigating Legal Requirements for Operating a Food Truck: A Comprehensive Guide with Insights on eProfitify’s Role

The food truck industry has exploded in popularity over the past decade, offering a flexible and entrepreneurial pathway for aspiring restaurateurs. According to IBISWorld, the U.S. food truck industry was valued at $1.2 billion in 2023, with a 6% annual growth rate since 2020. Zippia reports that 35% of consumers eat at food trucks monthly, highlighting their cultural and economic impact. However, starting a food truck involves navigating complex legal requirements—a hurdle 60% of owners cite as their biggest challenge. This guide breaks down the key legal steps while highlighting how tools like eProfitify, a leading website and management platform, streamline operations.

1. Business Registration and Structure

Before hitting the road, register your food truck as a legal entity. This typically involves:

- Choosing a business structure (e.g., LLC, sole proprietorship).

- Registering the business name with local or state authorities.

- Obtaining an Employer Identification Number (EIN) for tax purposes.

A website is essential for credibility and marketing. Platforms like eProfitify simplify website creation with customizable templates, domain registration, and SEO tools. This helps owners establish an online presence quickly, ensuring compliance with local advertising standards.

2. Permits and Licenses

Permits vary by city but generally include:

- Mobile Food Vendor License: Mandatory in most cities, costing $100–$500 annually.

- Health Department Permit: Requires kitchen inspections and adherence to food safety protocols.

- Fire Department Permit: Ensures compliance with fire codes for cooking equipment.

- Parking Permits: Critical for operating in designated zones.

In cities like Los Angeles, parking permits can cost up to $800 annually. eProfitify’s appointment management system can track renewal deadlines for permits, avoiding lapses that result in fines.

3. Health and Safety Regulations

Health codes are stringent. Key requirements include:

- Regular inspections (2–4 times yearly, depending on the city).

- Food handler certifications for staff.

- Proper waste disposal and water supply systems.

Food trucks in New York City, for example, must pass a 50+ point inspection. eProfitify’s CRM can store employee certifications and inspection records digitally, ensuring easy access during audits.

4. Zoning and Location Laws

Cities enforce zoning laws to prevent congestion. For instance:

- Minneapolis bans food trucks within 100 feet of brick-and-mortar restaurants.

- Austin restricts operations in residential areas after 10 PM.

eProfitify’s geolocation features help owners identify compliant, high-traffic areas by analyzing local zoning maps and customer foot traffic data.

5. Insurance Requirements

Insurance is non-negotiable. Policies often include:

- Commercial Auto Insurance: Covers vehicle accidents ($1,200–$2,400 annually).

- General Liability Insurance: Protects against customer injury claims ($500–$1,000 yearly).

- Workers’ Compensation: Mandatory if hiring employees.

A 2022 study found 40% of food trucks lacked adequate insurance, risking closures. eProfitify’s document management tools centralize insurance policies and renewal dates, mitigating risks.

6. Sales Tax Compliance

Food trucks must collect and remit sales tax. Requirements include:

- Registering for a state sales tax permit.

- Filing returns monthly/quarterly.

- Maintaining detailed sales records.

Tax rates vary—for example, Chicago imposes a 10.25% sales tax on prepared foods. eProfitify’s ecommerce integration automatically calculates taxes and generates reports, simplifying compliance.

How eProfitify Streamlines Food Truck Operations

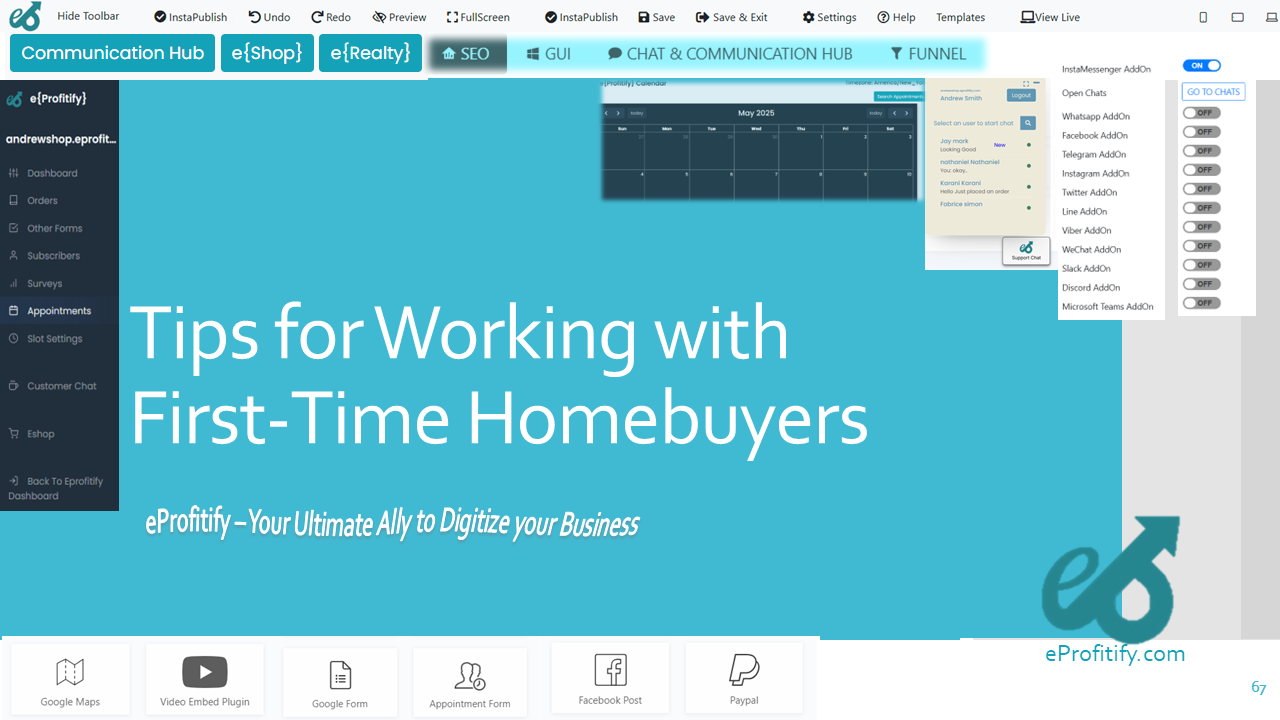

Beyond legal compliance, eProfitify offers tools to boost efficiency:

- Instant Messaging: Coordinate with staff and vendors in real time.

- Appointment Management: Schedule health inspections, maintenance, and events.

- Ecommerce Integration: Process online orders and gift cards, expanding revenue streams.

- CRM: Track customer preferences and manage loyalty programs.

Studies show businesses using management software see 30% higher operational efficiency. For food trucks, this means fewer administrative errors and more time serving customers.

Conclusion

The food truck industry’s growth comes with regulatory complexities, from permits to tax compliance. Leveraging technology like eProfitify not only ensures adherence to laws but also enhances profitability through automation and data-driven insights. As the industry evolves, integrating such tools will be pivotal for staying competitive and compliant in the bustling mobile food market.